Investing in index funds has become an increasingly popular choice for individuals looking to grow their wealth over time. Two of the most prominent options in the market are FXAIX (Fidelity 500 Index Fund) and VOO (Vanguard S&P 500 ETF). Both funds track the S&P 500 index, but they come with distinct characteristics that can significantly impact your investment strategy.

Whether you're a seasoned investor or just starting your financial journey, understanding the differences between FXAIX vs VOO is crucial. This article aims to provide an in-depth comparison to help you make informed decisions about where to allocate your resources.

By examining factors such as expense ratios, management styles, historical performance, and other key metrics, we'll break down the strengths and weaknesses of each fund. Let's dive into the details to uncover which option aligns best with your financial goals.

Read also:Exploring Morgan Wallens Age How Old Is He In 2024

Table of Contents

- Overview of FXAIX and VOO

- Key Differences Between FXAIX and VOO

- Historical Performance Analysis

- Expense Ratio Comparison

- Tax Implications

- Management and Investment Strategy

- Liquidity and Trading Flexibility

- Suitability for Different Investor Profiles

- Risks and Considerations

- Conclusion and Final Thoughts

Overview of FXAIX and VOO

Understanding FXAIX

FXAIX, or the Fidelity 500 Index Fund, is one of the largest mutual funds available in the market. Managed by Fidelity Investments, this fund aims to replicate the performance of the S&P 500 Index. With a long-standing history of delivering solid returns, FXAIX has become a go-to choice for many investors.

Key features of FXAIX include its low expense ratio, minimal investment requirements, and a strong track record of performance. It is particularly appealing to those who prefer mutual funds over exchange-traded funds (ETFs).

Understanding VOO

VOO, or the Vanguard S&P 500 ETF, is another powerhouse in the world of index funds. Managed by Vanguard, one of the most respected names in finance, VOO tracks the S&P 500 Index and offers investors exposure to the largest U.S. companies.

VOO stands out due to its liquidity, competitive expense ratio, and ability to trade like a stock. These characteristics make it an attractive option for both long-term investors and those seeking more flexibility in their portfolios.

Key Differences Between FXAIX and VOO

While both FXAIX and VOO track the same index, there are several key differences that set them apart:

- Fund Type: FXAIX is a mutual fund, whereas VOO is an ETF.

- Trading Flexibility: VOO can be traded throughout the day like a stock, while FXAIX transactions occur only at the end of the trading day.

- Expense Ratios: Both funds offer competitive expense ratios, but slight variations exist between the two.

- Minimum Investment: FXAIX typically requires a lower initial investment compared to purchasing shares of VOO.

Historical Performance Analysis

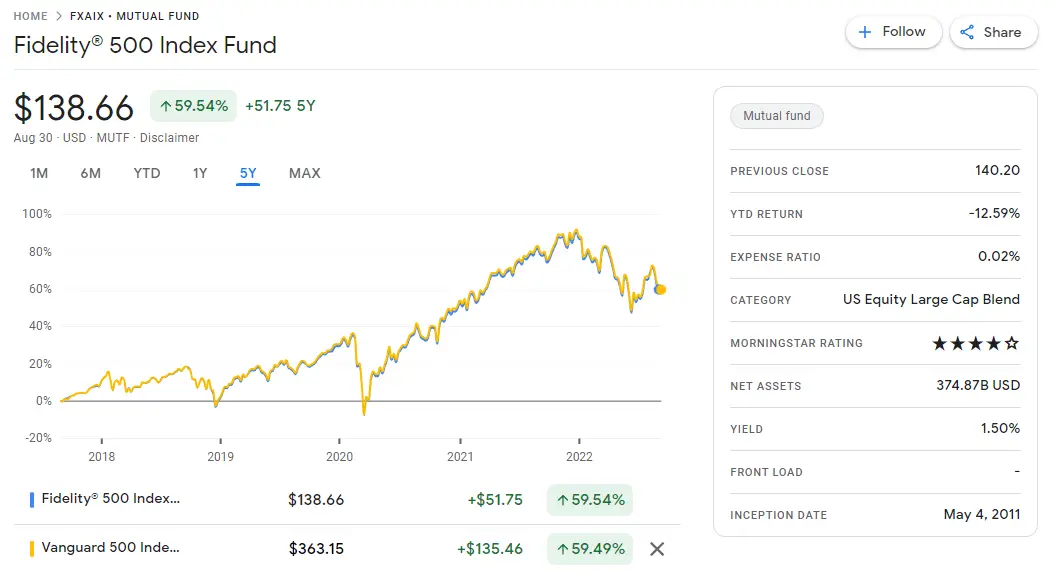

When evaluating FXAIX vs VOO, it's essential to consider their historical performance. Both funds aim to mirror the S&P 500 Index, so their returns should closely align with the index's performance over time.

Read also:Heartwarming Moments The Kid And His Mom Cctv Video On Reddit

According to data from Morningstar and other reputable sources, both FXAIX and VOO have delivered consistent annualized returns over the past decade. However, slight discrepancies may arise due to differences in management fees and trading costs.

Expense Ratio Comparison

Expense ratios play a critical role in determining the overall cost of investing in either FXAIX or VOO. Lower expense ratios translate to higher net returns for investors.

- FXAIX has an expense ratio of 0.015%, making it one of the cheapest mutual funds available.

- VOO boasts an even lower expense ratio of 0.03%, further enhancing its appeal to cost-conscious investors.

While the difference in expense ratios may seem negligible, over time, even small variations can significantly impact your portfolio's growth.

Tax Implications

Tax efficiency is another critical factor to consider when comparing FXAIX vs VOO. ETFs like VOO tend to be more tax-efficient due to their unique structure, which allows them to minimize capital gains distributions.

Mutual funds like FXAIX, on the other hand, may generate more taxable events, especially if there are frequent portfolio adjustments. Investors should weigh these tax implications based on their individual circumstances and investment horizons.

Management and Investment Strategy

FXAIX Management

FXAIX is managed by Fidelity Investments, a company known for its expertise in index fund management. The fund employs a passive investment strategy, aiming to replicate the performance of the S&P 500 Index with minimal deviations.

VOO Management

VOO is managed by Vanguard, a leader in the ETF space. Like FXAIX, VOO follows a passive investment approach, ensuring that its holdings closely match the composition of the S&P 500 Index.

Both funds benefit from the experience and resources of their respective management teams, providing investors with confidence in their ability to execute their strategies effectively.

Liquidity and Trading Flexibility

Liquidity is a significant advantage of ETFs like VOO. Since VOO trades on major stock exchanges, investors can buy and sell shares throughout the trading day at market prices. This flexibility makes VOO an ideal choice for those who prefer active management of their portfolios.

FXAIX, as a mutual fund, operates differently. Transactions occur only at the end of the trading day, based on the fund's net asset value (NAV). While this may limit trading flexibility, it also reduces the potential for market volatility to impact your investment decisions.

Suitability for Different Investor Profiles

The choice between FXAIX and VOO ultimately depends on your investment goals and preferences:

- Long-Term Investors: Both funds are well-suited for long-term investors seeking exposure to the S&P 500 Index.

- Cost-Conscious Investors: VOO's slightly lower expense ratio may make it more appealing to those prioritizing cost efficiency.

- Flexibility Seekers: If trading flexibility is a priority, VOO's ETF structure provides an advantage over FXAIX.

Risks and Considerations

While FXAIX and VOO offer attractive opportunities for growth, they are not without risks. Key considerations include:

- Market Risk: Both funds are subject to fluctuations in the stock market, which can impact their value.

- Interest Rate Risk: Changes in interest rates can influence the performance of the underlying companies in the S&P 500 Index.

- Concentration Risk: Since both funds focus on the S&P 500, they may be more susceptible to sector-specific downturns.

Investors should carefully assess these risks in the context of their overall financial plans.

Conclusion and Final Thoughts

In conclusion, the decision between FXAIX vs VOO comes down to your specific needs and preferences as an investor. Both funds offer excellent opportunities to gain exposure to the S&P 500 Index, with slight variations in structure, cost, and flexibility.

For those who prioritize trading flexibility and tax efficiency, VOO may be the better choice. On the other hand, investors seeking a straightforward mutual fund option with a strong track record may find FXAIX more appealing.

We encourage you to take action by reviewing your investment objectives, risk tolerance, and financial situation before making a decision. Feel free to leave a comment below with your thoughts or questions, and don't hesitate to explore other articles on our site for additional insights into the world of investing.