Preferred Credit Union has become a cornerstone for financial stability and growth in today’s economy. Whether you’re looking for competitive rates, personalized services, or a community-driven approach to banking, Preferred Credit Union stands out as a reliable option. In this article, we will explore the many benefits of becoming a member, the unique advantages it offers, and how it compares to traditional banks.

As more people seek alternatives to traditional banking, credit unions like Preferred Credit Union have gained prominence. They offer a member-centric model, ensuring that your financial needs are met with care and transparency. This article delves into the reasons why Preferred Credit Union is the preferred choice for many individuals and families.

From competitive loan rates to exceptional customer service, Preferred Credit Union continues to set the standard for financial institutions. Discover how this credit union can help you achieve your financial goals while fostering a sense of community and trust.

Read also:Tim Robbins The Multifaceted Actor And Filmmaker

Table of Contents

- What is Preferred Credit Union?

- Benefits of Joining Preferred Credit Union

- Comparison with Traditional Banks

- Services Offered by Preferred Credit Union

- The Process of Joining Preferred Credit Union

- Preferred Credit Union's Impact on the Community

- Member Testimonials and Success Stories

- Financial Advice and Resources

- Security Measures at Preferred Credit Union

- Future Plans and Expansion

What is Preferred Credit Union?

Preferred Credit Union is a member-owned financial cooperative that operates on a not-for-profit basis. Unlike traditional banks, which prioritize profit for shareholders, Preferred Credit Union focuses on providing value to its members. Founded with the mission of empowering communities through financial education and services, this credit union has grown to serve thousands of individuals across the country.

The core philosophy of Preferred Credit Union revolves around fostering financial wellness and building strong relationships with its members. By offering competitive rates on loans, savings accounts, and other financial products, the credit union ensures that its members receive the best possible value for their money.

History of Preferred Credit Union

Preferred Credit Union was established over three decades ago by a group of community leaders who recognized the need for a financial institution that prioritized its members' needs. Since then, it has expanded its reach and services, adapting to the changing financial landscape while staying true to its founding principles.

Benefits of Joining Preferred Credit Union

Becoming a member of Preferred Credit Union comes with numerous benefits that set it apart from traditional banks. Here are some of the key advantages:

- Lower Fees: Preferred Credit Union offers reduced fees on various services, including checking accounts and ATM withdrawals.

- Competitive Rates: Members enjoy competitive interest rates on loans and savings accounts, helping them save money in the long run.

- Personalized Service: With a focus on member satisfaction, Preferred Credit Union provides personalized service tailored to individual needs.

- Financial Education: The credit union offers resources and workshops to help members improve their financial literacy.

Exclusive Member Perks

In addition to the standard benefits, Preferred Credit Union members have access to exclusive perks, such as discounted rates on certain products and services. These perks are designed to enhance the overall member experience and provide added value.

Read also:Understanding The Conversion 590 Kg To Lbs

Comparison with Traditional Banks

When comparing Preferred Credit Union to traditional banks, several key differences emerge. While banks often prioritize profit over customer satisfaction, credit unions like Preferred focus on delivering value to their members. Here's a breakdown of the main differences:

- Ownership: Credit unions are member-owned, whereas banks are owned by shareholders.

- Profit Model: Credit unions operate on a not-for-profit basis, reinvesting earnings into member benefits.

- Customer Service: Credit unions typically offer more personalized and attentive service compared to larger banks.

Why Choose Preferred Credit Union Over a Bank?

Preferred Credit Union stands out due to its commitment to community engagement and member satisfaction. By choosing this credit union, you're not just opening an account; you're becoming part of a supportive financial community.

Services Offered by Preferred Credit Union

Preferred Credit Union offers a wide range of services designed to meet the diverse financial needs of its members. From checking and savings accounts to loans and investment options, the credit union provides comprehensive solutions for all stages of life.

Checking and Savings Accounts

Preferred Credit Union offers multiple types of checking and savings accounts, each tailored to specific needs. These accounts come with features such as low minimum balance requirements and high-interest rates, ensuring that members get the most out of their deposits.

Loan Products

Whether you're buying a home, financing a car, or consolidating debt, Preferred Credit Union offers competitive loan products. With flexible terms and low-interest rates, these loans make it easier for members to achieve their financial goals.

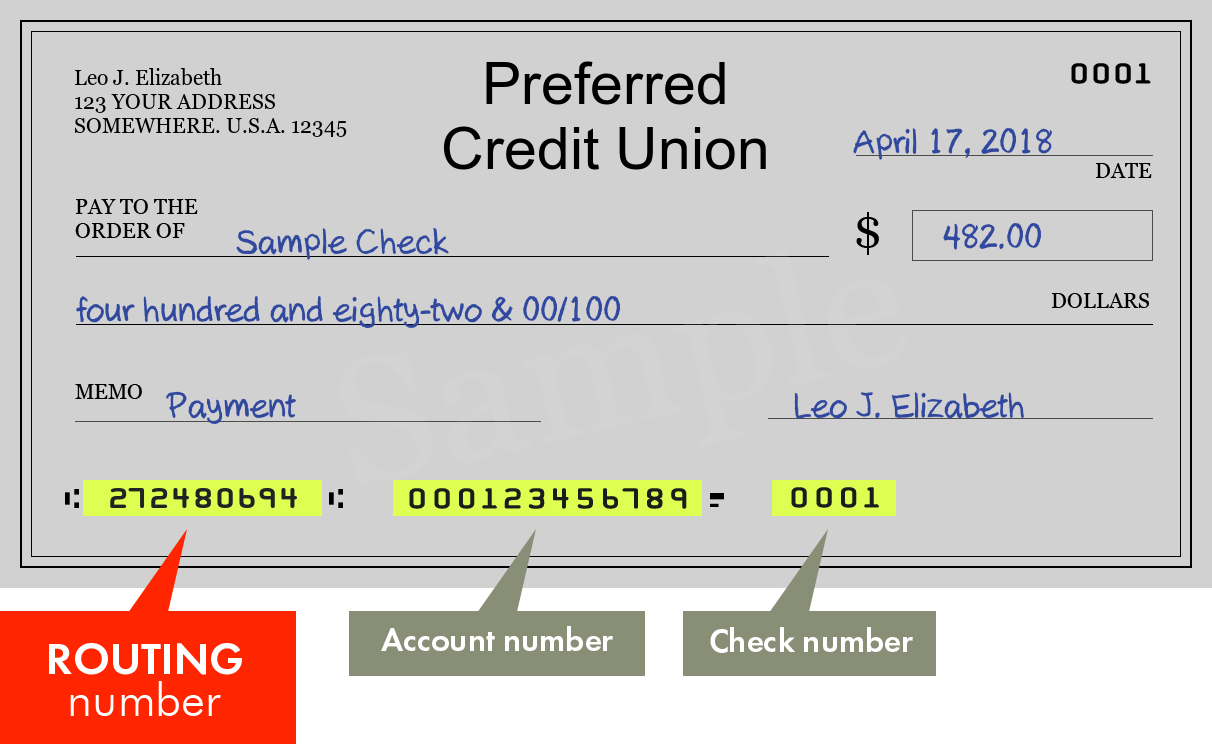

The Process of Joining Preferred Credit Union

Becoming a member of Preferred Credit Union is a straightforward process. To qualify, you must meet specific eligibility criteria, such as residing in a certain geographic area or belonging to a qualifying organization. Once eligible, you can join by completing an application and making a small deposit into a share account.

Eligibility Requirements

Preferred Credit Union serves a wide range of individuals, including residents of specific counties and members of partner organizations. If you meet the eligibility criteria, you can enjoy the many benefits of membership.

Preferred Credit Union's Impact on the Community

Preferred Credit Union is deeply committed to giving back to the communities it serves. Through partnerships with local organizations and initiatives aimed at financial education, the credit union plays a vital role in promoting economic growth and stability.

Community Programs

Some of the programs supported by Preferred Credit Union include financial literacy workshops for students, small business grants, and charitable donations to local nonprofits. These efforts underscore the credit union's dedication to making a positive impact.

Member Testimonials and Success Stories

Many members of Preferred Credit Union have shared their positive experiences and success stories. From securing affordable loans to achieving financial independence, these testimonials highlight the real-world benefits of being a member.

Success Stories

One member, Jane Doe, shared how Preferred Credit Union helped her purchase her first home with a low-interest mortgage. Another member, John Smith, praised the credit union's personalized service, which helped him consolidate his debt and improve his credit score.

Financial Advice and Resources

Preferred Credit Union provides a wealth of resources to help members make informed financial decisions. From online calculators to one-on-one consultations, these tools empower members to take control of their finances.

Online Resources

The credit union's website features a variety of educational materials, including articles, videos, and webinars. These resources cover topics such as budgeting, saving, and investing, providing members with the knowledge they need to succeed financially.

Security Measures at Preferred Credit Union

Preferred Credit Union places a strong emphasis on security, ensuring that member information and funds are protected at all times. Advanced encryption technologies and fraud detection systems are just a few of the measures in place to safeguard member accounts.

Data Protection

Members can rest assured knowing that their personal and financial data is secure. Preferred Credit Union adheres to the highest industry standards for data protection, including regular security audits and compliance with relevant regulations.

Future Plans and Expansion

Looking ahead, Preferred Credit Union has ambitious plans for growth and expansion. These include opening new branches, enhancing digital banking capabilities, and introducing innovative financial products to better serve its members.

Innovative Initiatives

As technology continues to evolve, Preferred Credit Union is committed to staying at the forefront of innovation. This includes investing in cutting-edge digital solutions and exploring new ways to enhance the member experience.

Kesimpulan

Preferred Credit Union offers a unique combination of personalized service, competitive rates, and community engagement that sets it apart from traditional banks. By becoming a member, you gain access to a wide range of financial products and resources designed to help you achieve your goals.

We encourage you to take the next step by visiting Preferred Credit Union's website or stopping by one of their branches. Share your thoughts and experiences in the comments below, and don't forget to explore other articles on our site for more valuable insights into personal finance.