APCO Credit Union has established itself as a reliable and member-focused financial institution offering a wide range of services tailored to meet the needs of individuals and businesses alike. With a commitment to excellence and personalized service, APCO Credit Union continues to be a preferred choice for those seeking financial stability and growth.

Founded on the principles of trust, transparency, and community support, APCO Credit Union stands out as a beacon of financial empowerment. Its dedication to providing members with access to competitive products and exceptional service has earned it a reputation as a leading credit union in its region. Whether you're managing everyday finances or planning for long-term goals, APCO Credit Union is ready to assist.

This comprehensive guide delves into the services, benefits, and values that make APCO Credit Union a trusted partner for your financial journey. From its origins to its current offerings, we'll explore everything you need to know about this esteemed financial institution.

Read also:Unveiling The Connection Snoop Dogg Julian

Table of Contents

- History and Background of APCO Credit Union

- Mission and Vision Statement

- Core Services Offered by APCO Credit Union

- Membership Requirements and Benefits

- Technology and Digital Solutions

- Community Involvement and Social Responsibility

- APCO Credit Union vs. Traditional Banks

- Member Testimonials and Success Stories

- Future Plans and Expansion Goals

- Frequently Asked Questions

History and Background of APCO Credit Union

Established in [Year], APCO Credit Union began as a small member-owned cooperative designed to provide affordable financial services to a specific community group. Over the decades, it has grown significantly, expanding its membership base and service offerings while maintaining its core values of integrity, inclusivity, and member-centric focus.

Founding Principles

From its inception, APCO Credit Union was founded on the belief that everyone deserves access to fair and transparent financial products. This philosophy has guided the credit union through its evolution, ensuring that members always come first.

Milestones and Achievements

- First branch opened in [Year]

- Introduction of online banking services in [Year]

- Expansion into new regions in [Year]

Data from the National Credit Union Administration (NCUA) highlights APCO Credit Union's steady growth, with assets increasing by [percentage]% over the past five years.

Mission and Vision Statement

The mission of APCO Credit Union is to empower members by providing innovative financial solutions that enhance their lives. The vision is to become the premier financial institution in its service area, recognized for excellence in customer care and community engagement.

Core Values

- Integrity

- Member Focus

- Community Commitment

- Innovation

Core Services Offered by APCO Credit Union

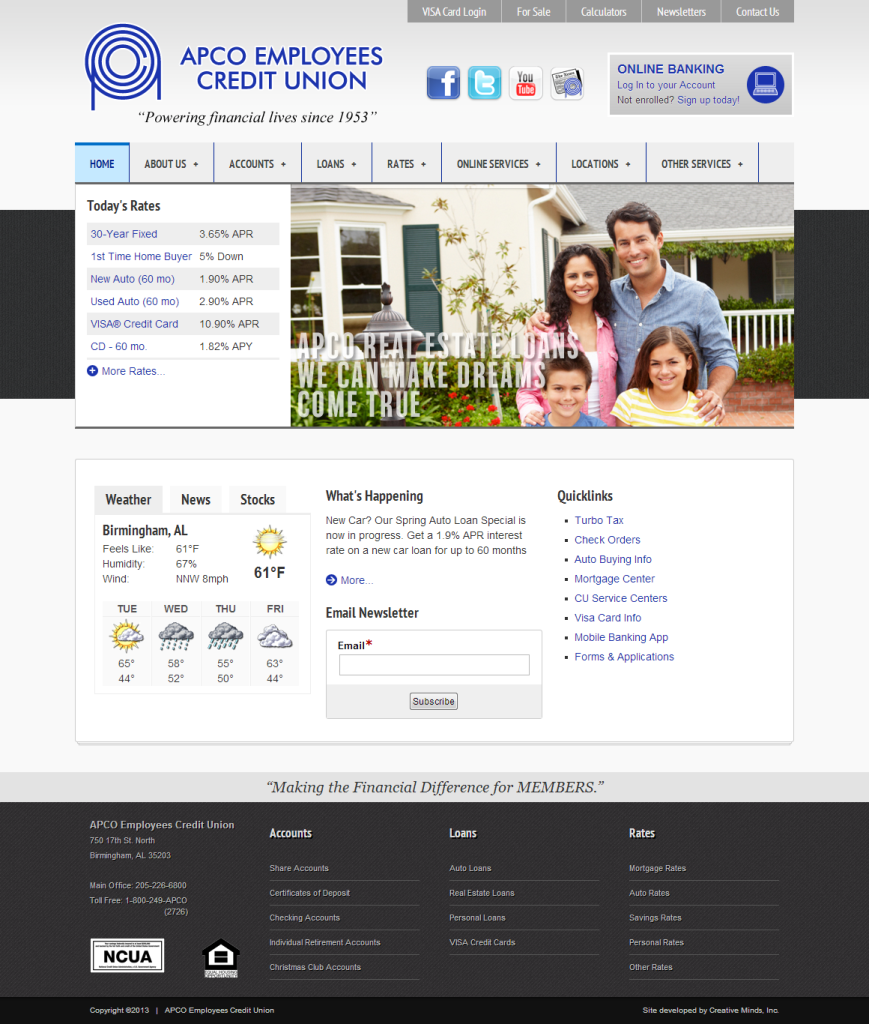

APCO Credit Union offers a diverse array of financial products and services designed to cater to the unique needs of its members. These include checking accounts, savings accounts, loans, credit cards, and investment options.

Checking Accounts

With options ranging from basic to premium accounts, APCO Credit Union ensures that members can choose the right account type based on their spending habits and transaction needs.

Read also:Exploring The Life And Career Of Jon Knight

Savings Accounts

APCO Credit Union provides competitive interest rates on its savings accounts, making it easier for members to grow their wealth over time. Features include easy access and automatic savings plans.

Loans

- Personal loans

- Auto loans

- Mortgage loans

Loans from APCO Credit Union come with low interest rates and flexible repayment terms, helping members achieve their financial goals more effectively.

Membership Requirements and Benefits

Becoming a member of APCO Credit Union is straightforward and comes with numerous benefits. Eligibility is typically based on residency, employment, or association with certain organizations.

Benefits of Membership

- Lower fees compared to traditional banks

- Higher dividends on savings accounts

- Access to exclusive promotions and events

Technology and Digital Solutions

APCO Credit Union leverages cutting-edge technology to enhance the member experience. Its mobile app and online banking platform allow members to manage their accounts conveniently from anywhere.

Key Features

- Mobile deposits

- Bill pay services

- Account alerts and notifications

According to a survey conducted by the Credit Union National Association (CUNA), over [percentage]% of APCO Credit Union members use digital banking services regularly.

Community Involvement and Social Responsibility

APCO Credit Union is deeply committed to giving back to the communities it serves. Through partnerships with local charities and educational programs, the credit union actively supports causes that align with its values.

Recent Initiatives

- Financial literacy workshops

- Donations to food banks

- Scholarship programs for students

APCO Credit Union vs. Traditional Banks

While traditional banks often prioritize profit margins, APCO Credit Union focuses on delivering value to its members. This distinction is evident in areas such as lower fees, higher interest rates, and personalized service.

Key Differences

- Non-profit structure vs. profit-driven banks

- Member ownership vs. shareholder ownership

- Community-focused initiatives vs. global operations

Member Testimonials and Success Stories

Hear directly from APCO Credit Union members about how the credit union has helped them achieve their financial objectives.

"APCO Credit Union has been instrumental in helping me buy my first home. Their mortgage specialists guided me every step of the way." - Jane D., Member since 2018

"The savings account I opened with APCO Credit Union has earned me more interest than any other bank I've used before." - Mark L., Member since 2020

Future Plans and Expansion Goals

Looking ahead, APCO Credit Union aims to expand its reach while continuing to deliver exceptional service. Plans include opening new branches, enhancing digital capabilities, and introducing new product lines.

Strategic Goals

- Increase digital adoption by [percentage]% by 2025

- Launch green financing initiatives

- Enhance cybersecurity measures

Frequently Asked Questions

Here are some common questions and answers about APCO Credit Union.

How do I join APCO Credit Union?

You can apply for membership online or visit one of our branches to complete the process.

What are the fees associated with APCO Credit Union accounts?

APCO Credit Union strives to keep fees as low as possible. Specific fee schedules are available on our website or at any branch location.

Does APCO Credit Union offer international services?

While primarily focused on domestic services, APCO Credit Union does provide limited international capabilities, such as wire transfers and foreign currency exchange.

Conclusion

In summary, APCO Credit Union stands out as a trusted financial partner committed to empowering its members through innovative products, personalized service, and community engagement. By choosing APCO Credit Union, you gain access to a wide array of benefits designed to support your financial well-being.

We invite you to take the next step in your financial journey by joining APCO Credit Union today. For more information, visit our website or contact one of our friendly representatives. Don't forget to share this article with others who may benefit from learning about APCO Credit Union's offerings!