Medina County Auditor is an essential part of the local government structure, responsible for managing financial records, property valuation, and ensuring fiscal transparency. If you live in Medina County or are interested in understanding how local governments operate, this article will provide you with all the information you need. From the responsibilities of the auditor to the impact on your daily life, we’ll cover it all.

The role of the Medina County Auditor goes beyond just numbers and spreadsheets. It plays a crucial role in shaping the financial health of the county and directly affects residents through property taxes, public spending, and more. Whether you’re a homeowner, a business owner, or simply a taxpayer, understanding the auditor's responsibilities is vital for staying informed about your community's financial well-being.

In this article, we’ll delve into the functions of the Medina County Auditor, explore how property assessments are conducted, and discuss the importance of transparency in local government finances. By the end of this guide, you’ll have a clearer picture of how the auditor's office operates and why it matters to you.

Read also:Discovering The Height Of Tim Robbins How Tall Is Actor Tim Robbins

Table of Contents

- Introduction to Medina County Auditor

- The Role of the Medina County Auditor

- Understanding Property Assessment

- Tax Collection and Management

- Promoting Financial Transparency

- Challenges Faced by the Auditor's Office

- Leveraging Technology in Audit Processes

- The Impact on the Local Community

- Future Developments in the Auditor's Office

- Conclusion and Next Steps

Introduction to Medina County Auditor

The Medina County Auditor is a vital entity within the local government framework, tasked with ensuring financial accountability and transparency. This office plays a key role in maintaining accurate records of property values, managing tax collections, and providing residents with clear insights into how public funds are allocated. Understanding the auditor’s responsibilities can help residents make informed decisions about their finances and community involvement.

One of the primary functions of the auditor is to assess property values accurately. This process directly impacts property taxes, which are a significant revenue source for local governments. By ensuring that assessments are fair and equitable, the auditor helps maintain trust between the government and its citizens. Additionally, the auditor oversees financial transactions, ensuring compliance with state and federal regulations.

The Role of the Medina County Auditor

Key Responsibilities

The Medina County Auditor has several key responsibilities that ensure the financial health of the county. These include:

- Property valuation and assessment

- Managing tax collections

- Maintaining accurate financial records

- Providing transparency in government spending

- Ensuring compliance with legal and regulatory requirements

Each of these responsibilities is critical to the functioning of the local government. For instance, accurate property assessments ensure that tax burdens are distributed fairly among residents, while transparent financial records build trust and accountability.

Understanding Property Assessment

How Property Values Are Determined

Property assessment is one of the most important functions of the Medina County Auditor. This process involves evaluating the market value of properties within the county to determine their tax liabilities. Several factors influence property valuations, including:

- Location and neighborhood characteristics

- Property size and condition

- Recent sales of comparable properties

- Improvements or renovations made to the property

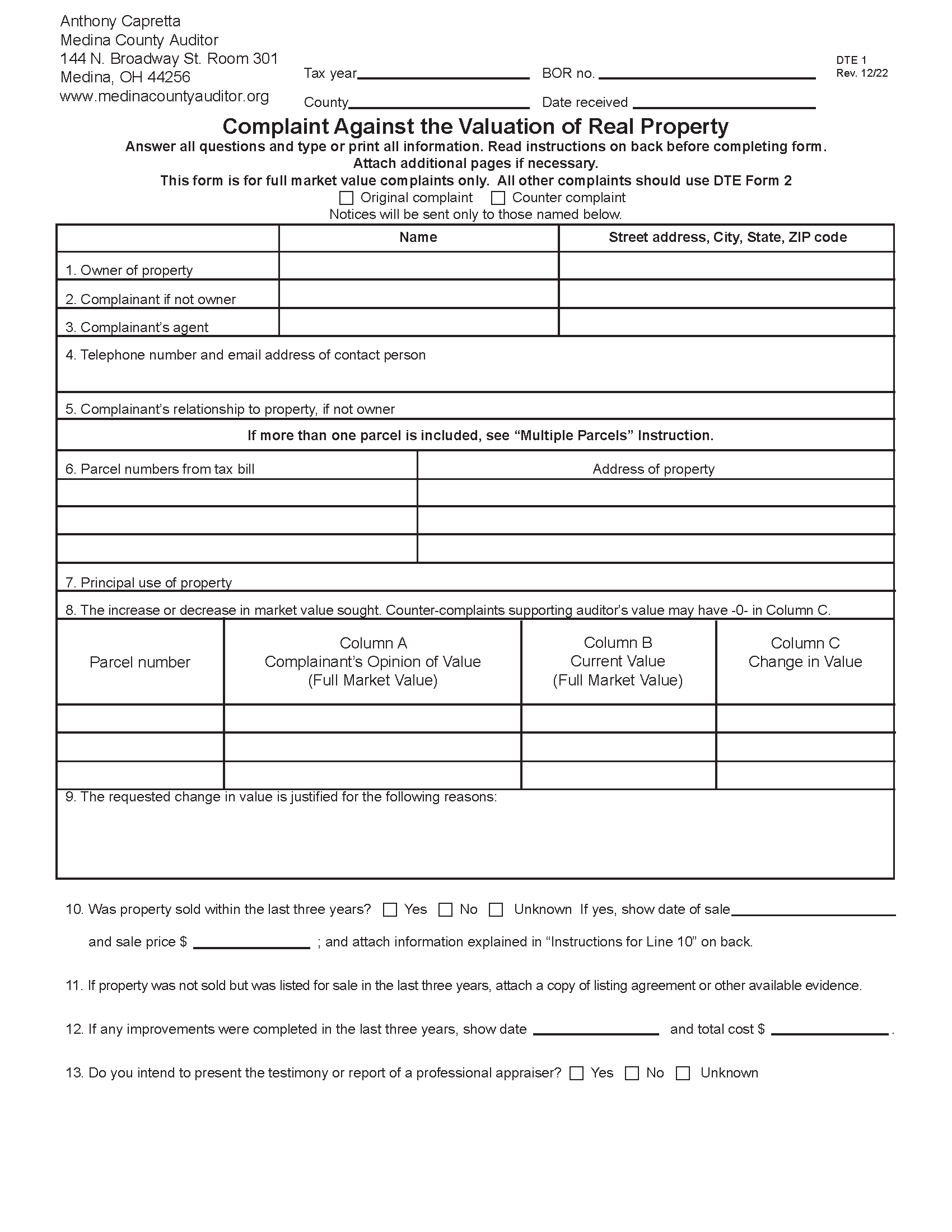

Accurate assessments are crucial for ensuring that property taxes are calculated fairly. Residents can appeal their assessments if they believe the valuation is incorrect, and the auditor’s office provides clear guidelines for this process.

Read also:Understanding The Conversion Of 1 65 Cm In Feet

Tax Collection and Management

Ensuring Fair Tax Distribution

Tax collection is another critical function of the Medina County Auditor. Property taxes fund essential services such as public schools, infrastructure maintenance, and emergency services. The auditor ensures that these funds are collected efficiently and distributed appropriately to meet the needs of the community.

Residents can access detailed information about their tax payments through the auditor’s website, which provides transparency into how their money is being used. This openness helps build trust between the government and its citizens, fostering a more engaged and informed community.

Promoting Financial Transparency

Building Trust Through Open Records

Financial transparency is a cornerstone of the Medina County Auditor’s mission. By providing open access to financial records, the auditor ensures that residents can see exactly how their tax dollars are being spent. This level of transparency is essential for maintaining public trust and encouraging civic participation.

Residents can access a variety of financial reports, including annual budgets, expenditure summaries, and revenue breakdowns. These documents are available online, making it easy for anyone to stay informed about the county’s financial health.

Challenges Faced by the Auditor's Office

Addressing Economic and Technological Challenges

Like many government offices, the Medina County Auditor faces several challenges in its day-to-day operations. Economic fluctuations can impact property values, making accurate assessments more difficult. Additionally, technological advancements require the auditor’s office to continually update its systems and processes to remain efficient and effective.

Another challenge is maintaining public trust in an era of increasing skepticism toward government institutions. The auditor’s office must work diligently to provide clear, accessible information that reassures residents of its commitment to transparency and accountability.

Leveraging Technology in Audit Processes

Incorporating Digital Tools for Efficiency

Technology plays a vital role in modernizing the Medina County Auditor’s operations. From online property assessment tools to digital record-keeping systems, these advancements help streamline processes and improve accuracy. For example, residents can now access property records and tax information online, reducing the need for in-person visits to the auditor’s office.

Additionally, the use of data analytics allows the auditor’s office to identify trends and patterns that may not be immediately apparent through traditional methods. This capability enhances decision-making and ensures that resources are allocated efficiently.

The Impact on the Local Community

Supporting Residents and Businesses

The work of the Medina County Auditor has a direct impact on the local community. By ensuring accurate property assessments and fair tax distribution, the auditor helps maintain a stable and prosperous environment for residents and businesses alike. This stability is essential for attracting new businesses, encouraging economic growth, and improving the overall quality of life in the county.

Residents benefit from the auditor’s commitment to transparency, as they can easily access information about their property taxes and how public funds are being used. This openness fosters a more engaged and informed citizenry, which is crucial for the health of any democracy.

Future Developments in the Auditor's Office

Adapting to Changing Needs

As the needs of the community evolve, so too must the Medina County Auditor’s office. Future developments may include further integration of technology, enhanced data analytics capabilities, and expanded outreach efforts to ensure that all residents have access to the information they need. By staying ahead of these trends, the auditor’s office can continue to provide exceptional service to the people of Medina County.

Additionally, the auditor may explore new ways to engage with residents, such as hosting community forums or developing educational resources to help people better understand their tax obligations and rights. These initiatives will further strengthen the relationship between the government and its citizens.

Conclusion and Next Steps

In conclusion, the Medina County Auditor plays a vital role in maintaining the financial health and transparency of the local government. By ensuring accurate property assessments, managing tax collections, and providing open access to financial records, the auditor helps build trust and accountability within the community. Understanding these responsibilities is crucial for residents who want to stay informed about their finances and community involvement.

We encourage you to explore the resources provided by the Medina County Auditor’s office and take an active role in shaping the future of your community. If you have questions or concerns, don’t hesitate to reach out to the auditor’s office for clarification. And, as always, feel free to share this article with others who may benefit from the information. Together, we can create a more informed and engaged society.

Data Sources: Medina County Official Website, IRS Guidelines, U.S. Census Bureau