Renting a home or apartment doesn't mean you have to compromise on protection. Lemonade renters insurance offers an innovative, tech-driven approach to safeguarding your belongings and lifestyle. In today's fast-paced world, having the right insurance coverage is crucial to ensure peace of mind. This article dives deep into everything you need to know about Lemonade renters insurance, from its features and benefits to pricing and claims processes.

Lemonade renters insurance has gained popularity for its user-friendly platform and commitment to transparency. By leveraging AI and machine learning, Lemonade simplifies the insurance process, making it accessible to renters of all backgrounds. Whether you're a young professional or a family looking for affordable protection, Lemonade offers tailored solutions to meet your needs.

In this comprehensive guide, we'll explore the ins and outs of Lemonade renters insurance. From understanding its coverage options to learning about its unique business model, you'll gain valuable insights to make informed decisions about protecting your property. Let's get started!

Read also:Understanding The Conversion 590 Kg To Lbs

Table of Contents

- Overview of Lemonade Renters Insurance

- What Does Lemonade Renters Insurance Cover?

- Key Benefits of Choosing Lemonade

- Understanding Lemonade Renters Insurance Pricing

- How to File a Lemonade Insurance Claim

- Lemonade's Cutting-Edge Technology

- Comparing Lemonade to Other Renters Insurance Providers

- Frequently Asked Questions About Lemonade Renters Insurance

- Tips for Maximizing Your Lemonade Policy

- Conclusion

Overview of Lemonade Renters Insurance

Lemonade renters insurance stands out in the insurance industry with its modern approach to customer service and policy management. Founded in 2016, Lemonade quickly became a favorite among tech-savvy renters. The company leverages artificial intelligence to streamline the claims process, offering quick and hassle-free solutions.

Why Choose Lemonade Renters Insurance?

One of the primary reasons renters choose Lemonade is its simplicity. The app-based platform allows users to sign up, manage policies, and file claims with ease. Lemonade also emphasizes its commitment to ethical practices by donating unused premiums to charity, aligning with socially conscious consumers.

Here are some key reasons to consider Lemonade:

- Fast claims processing using AI

- Transparent pricing structure

- Charitable contributions from unclaimed funds

What Does Lemonade Renters Insurance Cover?

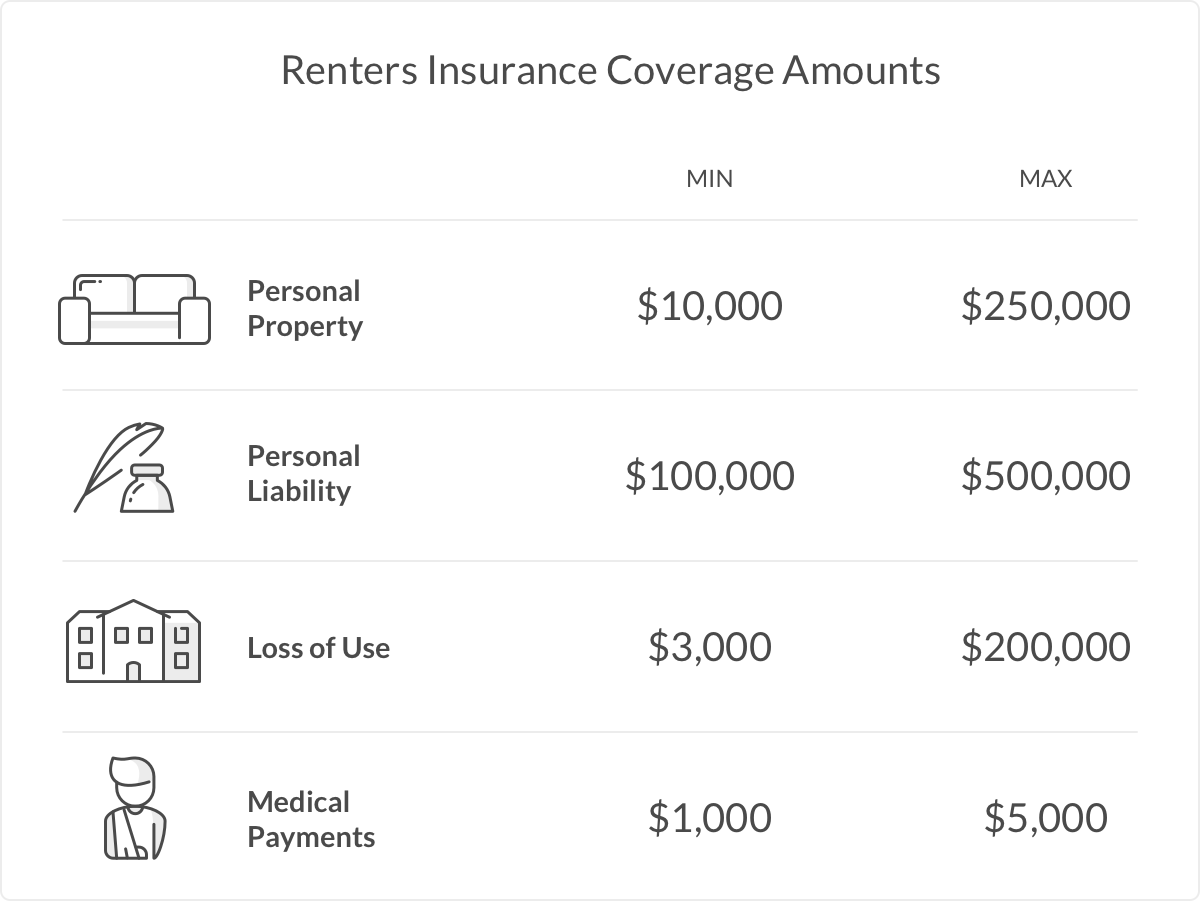

Understanding what Lemonade renters insurance covers is essential for making the right decision. The policy typically includes protection for personal property, liability, and additional living expenses (ALE).

Personal Property Protection

This coverage protects your belongings from theft, damage, or loss due to covered perils such as fire, theft, or vandalism. Lemonade offers a comprehensive list of covered items, including electronics, furniture, and jewelry.

Liability Coverage

Liability coverage protects you if someone is injured in your rented space or if you accidentally cause damage to someone else's property. Lemonade provides up to $1 million in liability protection, which can be increased for an additional fee.

Read also:Unraveling The Mystery Is Summer Wells Alive

Additional Living Expenses (ALE)

If your rental becomes uninhabitable due to a covered event, Lemonade covers the cost of temporary housing and other necessary living expenses. This ensures that you're not left without a place to stay during repairs.

Key Benefits of Choosing Lemonade

Lemonade renters insurance offers several advantages that set it apart from traditional providers:

Instant Claims Settlement

Using AI-powered chatbots, Lemonade can settle straightforward claims in as little as three seconds. This speed and efficiency are unmatched in the industry.

Transparent Pricing

Lemonade charges a flat fee for its services and donates unclaimed funds to charity, ensuring that customers pay only for the coverage they need.

Mobile-Friendly Platform

With a sleek app and website, Lemonade makes managing your policy a breeze. You can adjust coverage limits, add riders, and file claims directly from your smartphone.

Understanding Lemonade Renters Insurance Pricing

Lemonade renters insurance is known for its affordable pricing. On average, policies start at around $5-10 per month, depending on your location and coverage needs.

Factors Affecting Premiums

Several factors influence the cost of your Lemonade policy:

- Location of your rental

- Value of your personal property

- Amount of liability coverage

- Presence of security features like alarms or deadbolts

It's important to review your policy annually to ensure you're getting the best rate possible.

How to File a Lemonade Insurance Claim

Filing a claim with Lemonade is straightforward and efficient:

Step-by-Step Guide

Follow these steps to file a claim:

- Open the Lemonade app or website

- Go to the "Claims" section

- Provide details about the incident

- Upload any necessary documentation or photos

- Receive a decision within minutes

Lemonade's AI-driven process ensures that claims are resolved quickly and fairly.

Lemonade's Cutting-Edge Technology

At the heart of Lemonade's success is its innovative use of technology. The company employs AI and machine learning to enhance the customer experience:

AI-Powered Chatbots

Lemonade's chatbots handle everything from policy inquiries to claims processing. These bots are available 24/7, providing instant assistance whenever you need it.

Data-Driven Insights

By analyzing vast amounts of data, Lemonade continuously improves its algorithms to better serve its customers. This commitment to innovation ensures that Lemonade remains at the forefront of the insurance industry.

Comparing Lemonade to Other Renters Insurance Providers

While Lemonade offers unique features, it's important to compare it to other providers:

Key Competitors

Some of Lemonade's main competitors include:

- Allstate

- State Farm

- GEICO

Each provider has its own strengths, so it's essential to evaluate your needs before choosing a policy.

Frequently Asked Questions About Lemonade Renters Insurance

Q: Is Lemonade available in all states?

A: Lemonade is currently available in most U.S. states, but coverage may vary depending on location.

Q: Can I add a roommate to my policy?

A: Yes, Lemonade allows you to add roommates to your policy for additional protection.

Q: Does Lemonade cover flood damage?

A: Flood damage is typically not covered by standard renters insurance policies. However, you can purchase a separate flood insurance policy if needed.

Tips for Maximizing Your Lemonade Policy

To get the most out of your Lemonade renters insurance:

- Regularly update your inventory of personal belongings

- Take advantage of discounts for security features

- Review your policy annually to ensure adequate coverage

By following these tips, you can ensure that your Lemonade policy meets all your needs.

Conclusion

In conclusion, Lemonade renters insurance offers a modern, tech-driven solution for protecting your belongings and lifestyle. With its transparent pricing, fast claims processing, and commitment to ethical practices, Lemonade is a top choice for renters seeking peace of mind.

We encourage you to explore Lemonade's offerings and consider how they align with your insurance needs. Don't forget to leave a comment or share this article with others who may benefit from the information. For more insights on insurance and personal finance, check out our other articles!

Data Source: Lemonade Insurance Company, Consumer Reports, and industry experts.