In the ever-changing world of finance, identifying 5 star rated stocks has become a crucial strategy for investors seeking long-term growth and stability. With countless options available in the stock market, knowing which stocks are worth your investment can be overwhelming. However, understanding how these ratings work and what factors contribute to them can significantly improve your investment decisions.

Investing in 5 star rated stocks offers a strategic advantage as these stocks are often evaluated based on their historical performance, financial health, and growth potential. By learning the nuances of what makes a stock worthy of a 5-star rating, you can make more informed decisions about where to allocate your resources.

This comprehensive guide will delve into the intricacies of 5 star rated stocks, offering you actionable insights into how to identify and invest in them successfully. Whether you're a seasoned investor or just starting, this article will provide you with the knowledge you need to navigate the market confidently.

Read also:Lorenzo Zurollo A Multifaceted Talent Shining In The Spotlight

Table of Contents

- What Are 5 Star Rated Stocks?

- Importance of Stock Ratings

- Criteria for 5 Star Ratings

- Identifying Top-Rated Stocks

- How to Analyze 5 Star Rated Stocks

- Historical Performance of 5 Star Rated Stocks

- Risks Associated with Investing in 5 Star Rated Stocks

- Long-Term Potential of 5 Star Rated Stocks

- Expert Opinions on 5 Star Rated Stocks

- Conclusion

What Are 5 Star Rated Stocks?

5 star rated stocks are equities that have been evaluated and assigned the highest possible rating by reputable financial rating agencies or platforms. These ratings are designed to help investors identify companies with strong fundamentals, consistent growth, and a solid track record in the market.

When a stock receives a 5-star rating, it signifies that it has met or exceeded the criteria set by analysts in terms of profitability, market position, and financial stability. Such stocks are often considered less risky and more likely to generate positive returns over time.

Why Do Ratings Matter?

Ratings matter because they provide a standardized method of evaluating stocks. Investors can use these ratings as a starting point for further research, helping them to make more informed decisions. Additionally, 5 star rated stocks are often favored by institutional investors, which can lead to increased demand and higher prices.

Importance of Stock Ratings

Stock ratings play a critical role in the investment process. They offer insights into the financial health and potential of a company, making it easier for investors to compare different stocks and choose the ones that align with their investment goals.

Investors can use stock ratings to gauge the risk and return potential of a stock. For instance, a 5 star rated stock may indicate lower risk and higher return potential compared to a stock with a lower rating. This information is invaluable for constructing a diversified investment portfolio.

Key Benefits of Stock Ratings

- Provide a standardized evaluation of stocks

- Help investors make informed decisions

- Indicate potential risks and returns

- Facilitate comparison between different stocks

Criteria for 5 Star Ratings

For a stock to be awarded a 5-star rating, it must meet several stringent criteria. These criteria typically include factors such as financial performance, market position, growth potential, and risk assessment. Analysts carefully evaluate each of these aspects to determine whether a stock deserves the highest rating.

Read also:Unveiling The Intriguing James Marsden Relationship Saga

Some of the key factors considered in assigning a 5-star rating include:

- Revenue Growth: Consistent and sustainable revenue growth over time.

- Profit Margins: High and stable profit margins compared to industry peers.

- Financial Health: Strong balance sheets with manageable debt levels.

- Management Quality: Competent leadership with a clear strategic vision.

How Analysts Evaluate Stocks

Analysts use a combination of quantitative and qualitative metrics to evaluate stocks. They analyze financial statements, industry trends, and competitive landscapes to assess the overall health and potential of a company. This thorough evaluation ensures that only the most deserving stocks receive the coveted 5-star rating.

Identifying Top-Rated Stocks

Identifying top-rated stocks requires a systematic approach. Investors can use various tools and resources to find stocks that have been awarded 5-star ratings. Financial news websites, brokerage platforms, and rating agencies are excellent sources of information for discovering top-rated stocks.

One effective way to identify 5 star rated stocks is by using stock screening tools. These tools allow investors to filter stocks based on specific criteria, such as rating, industry, and market capitalization. By narrowing down the options, investors can focus on stocks that meet their investment criteria.

Top Resources for Finding Rated Stocks

- Financial news websites like Bloomberg and Reuters

- Brokerage platforms offering stock screening tools

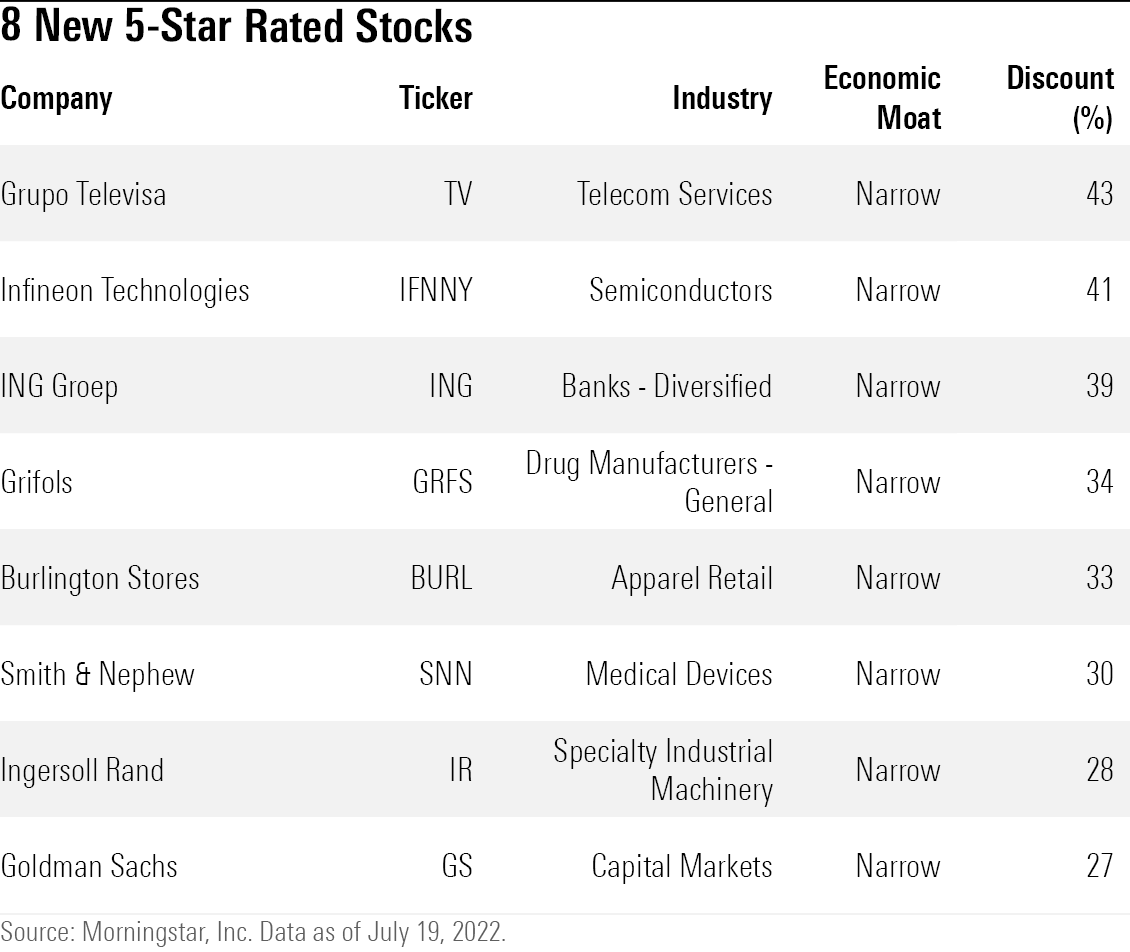

- Rating agencies such as Morningstar and Standard & Poor's

How to Analyze 5 Star Rated Stocks

Analyzing 5 star rated stocks involves a deeper dive into the company's financials, market position, and growth prospects. Investors should review key financial metrics, such as earnings per share (EPS), price-to-earnings (P/E) ratio, and return on equity (ROE), to assess the stock's value and potential.

Additionally, it's essential to consider external factors that may impact the stock's performance, such as economic conditions, regulatory changes, and industry trends. By combining quantitative analysis with qualitative insights, investors can gain a comprehensive understanding of a stock's potential.

Key Metrics for Analysis

- Earnings Per Share (EPS)

- Price-to-Earnings (P/E) Ratio

- Return on Equity (ROE)

- Debt-to-Equity Ratio

Historical Performance of 5 Star Rated Stocks

The historical performance of 5 star rated stocks is an important indicator of their future potential. Studies have shown that stocks with high ratings tend to outperform those with lower ratings over the long term. This trend is attributed to their strong fundamentals and consistent growth.

Investors can analyze historical data to identify patterns and trends in the performance of 5 star rated stocks. By understanding how these stocks have performed in the past, investors can make more informed decisions about their future investments.

Case Studies of Successful Stocks

Several 5 star rated stocks have demonstrated exceptional performance over the years. For instance, companies like Apple, Microsoft, and Amazon have consistently delivered strong returns to their investors. These companies have maintained their high ratings due to their innovative business models and robust financial performance.

Risks Associated with Investing in 5 Star Rated Stocks

While 5 star rated stocks offer significant potential for growth, they are not without risks. Market volatility, economic downturns, and unforeseen events can impact the performance of even the most highly-rated stocks. Investors must be aware of these risks and take steps to mitigate them.

It's important to diversify your portfolio to reduce risk exposure. By investing in a mix of stocks across different sectors and industries, you can minimize the impact of any single stock's underperformance. Additionally, staying informed about market trends and economic indicators can help you make timely adjustments to your portfolio.

Strategies for Risk Management

- Diversify your investment portfolio

- Stay informed about market trends and economic indicators

- Set clear investment goals and regularly review your portfolio

Long-Term Potential of 5 Star Rated Stocks

The long-term potential of 5 star rated stocks is one of their most attractive features. These stocks are often associated with companies that have a strong competitive advantage and a clear growth strategy. As a result, they are more likely to deliver consistent returns over time.

Investors who adopt a long-term investment approach can benefit significantly from investing in 5 star rated stocks. By holding onto these stocks for an extended period, investors can capitalize on their growth potential and achieve their financial goals.

Factors Influencing Long-Term Growth

- Innovative business models

- Strong brand recognition

- Robust financial performance

- Adaptability to changing market conditions

Expert Opinions on 5 Star Rated Stocks

Experts in the financial industry often provide valuable insights into the world of 5 star rated stocks. Their opinions can help investors gain a deeper understanding of the factors that contribute to a stock's rating and its potential for growth.

According to a study by Morningstar, stocks with high ratings tend to outperform those with lower ratings over the long term. This finding underscores the importance of considering stock ratings when making investment decisions. Additionally, many experts emphasize the need for thorough research and due diligence before investing in any stock.

Advice from Industry Experts

Investment professionals recommend focusing on the fundamentals of a company when evaluating its stock. They advise investors to look beyond the rating and consider factors such as management quality, competitive positioning, and long-term growth prospects. By taking a holistic approach, investors can make more informed decisions about their investments.

Conclusion

Investing in 5 star rated stocks can be a rewarding strategy for those seeking long-term growth and stability. By understanding the criteria for these ratings and analyzing the factors that contribute to a stock's performance, investors can make more informed decisions about where to allocate their resources.

We encourage you to explore the resources mentioned in this article and conduct your own research to identify 5 star rated stocks that align with your investment goals. Don't forget to diversify your portfolio and stay informed about market trends to maximize your returns. Share your thoughts and experiences in the comments below, and consider exploring other articles on our site for more investment insights.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/W73FI6IRVDYOBHV2VNQLPU34FI.png)