Understanding the PPP warrant list is crucial for businesses that participated in the Paycheck Protection Program (PPP). This list provides insight into the warrants issued due to fraudulent activities or mismanagement. The PPP warrant list plays a significant role in ensuring transparency and accountability in government-backed loan programs.

The Paycheck Protection Program (PPP) was introduced as part of the CARES Act to support small businesses during the economic downturn caused by the pandemic. While the program aimed to provide financial relief, it also became a target for fraudsters. As a result, the PPP warrant list emerged as a tool to track and address these fraudulent activities.

This guide delves into the intricacies of the PPP warrant list, explaining its purpose, implications, and how businesses can stay compliant. Whether you're a business owner, a legal professional, or simply curious about the program, this article will provide valuable insights. Let's explore the topic in detail.

Read also:Peter Strauss A Journey Through The Life Of A Versatile Actor

Table of Contents

- What is PPP Warrant List?

- History of PPP

- Why PPP Warrant List Matters

- How PPP Warrant List is Created

- Impact on Businesses

- Legal Actions Associated

- How to Check PPP Warrant List

- Preventing Fraud in PPP

- Statistics and Data

- Conclusion

What is PPP Warrant List?

The PPP warrant list refers to an official document that lists individuals or entities suspected of fraudulent activities related to the Paycheck Protection Program. This list is maintained by federal authorities to ensure accountability and transparency in the program's implementation. Businesses or individuals on this list may face legal consequences, including fines or imprisonment.

Key Features of PPP Warrant List

- Lists individuals or entities involved in fraudulent activities.

- Updated regularly based on new investigations and findings.

- Accessible to the public for transparency purposes.

Understanding the PPP warrant list is vital for businesses to avoid potential legal issues and maintain compliance with federal regulations.

History of PPP

The Paycheck Protection Program (PPP) was launched in 2020 as part of the CARES Act to provide financial assistance to small businesses affected by the pandemic. The program aimed to help businesses retain their workforce by offering forgivable loans. However, due to its rapid implementation, the program faced numerous challenges, including fraud and mismanagement.

Evolution of PPP

- Initial rollout in April 2020.

- Multiple rounds of funding to address growing demand.

- Introduction of stricter regulations to combat fraud.

The history of PPP highlights the program's significance and the challenges it faced, leading to the creation of the PPP warrant list.

Why PPP Warrant List Matters

The PPP warrant list is crucial for maintaining transparency and accountability in government-backed loan programs. By identifying fraudulent activities, the list helps protect taxpayer funds and ensures that businesses in genuine need receive assistance. It also serves as a deterrent for potential fraudsters, reinforcing the program's integrity.

For businesses, being aware of the PPP warrant list is essential to avoid legal complications and maintain a clean reputation. Staying informed about the list's contents and updates can help businesses navigate the program effectively.

Read also:Unveiling The Mystery Who Was Married To Rick Moranis

How PPP Warrant List is Created

The PPP warrant list is created through a comprehensive investigation process conducted by federal authorities. This involves analyzing loan applications, cross-referencing data, and identifying suspicious activities. Once potential fraud is detected, the relevant individuals or entities are added to the list.

Steps in Creating the PPP Warrant List

- Data analysis of PPP loan applications.

- Investigation of suspicious activities.

- Verification of findings with legal authorities.

This meticulous process ensures that only individuals or entities involved in fraudulent activities are included on the list, minimizing errors and ensuring fairness.

Impact on Businesses

Being listed on the PPP warrant list can have severe consequences for businesses. It may lead to legal actions, financial penalties, and damage to the company's reputation. Additionally, businesses on the list may face difficulties in accessing future government assistance programs.

Potential Impacts

- Legal actions, including fines or imprisonment.

- Reputation damage affecting customer trust.

- Difficulty in securing future loans or grants.

Businesses must take proactive measures to avoid these impacts by ensuring compliance with PPP regulations and maintaining transparency in financial dealings.

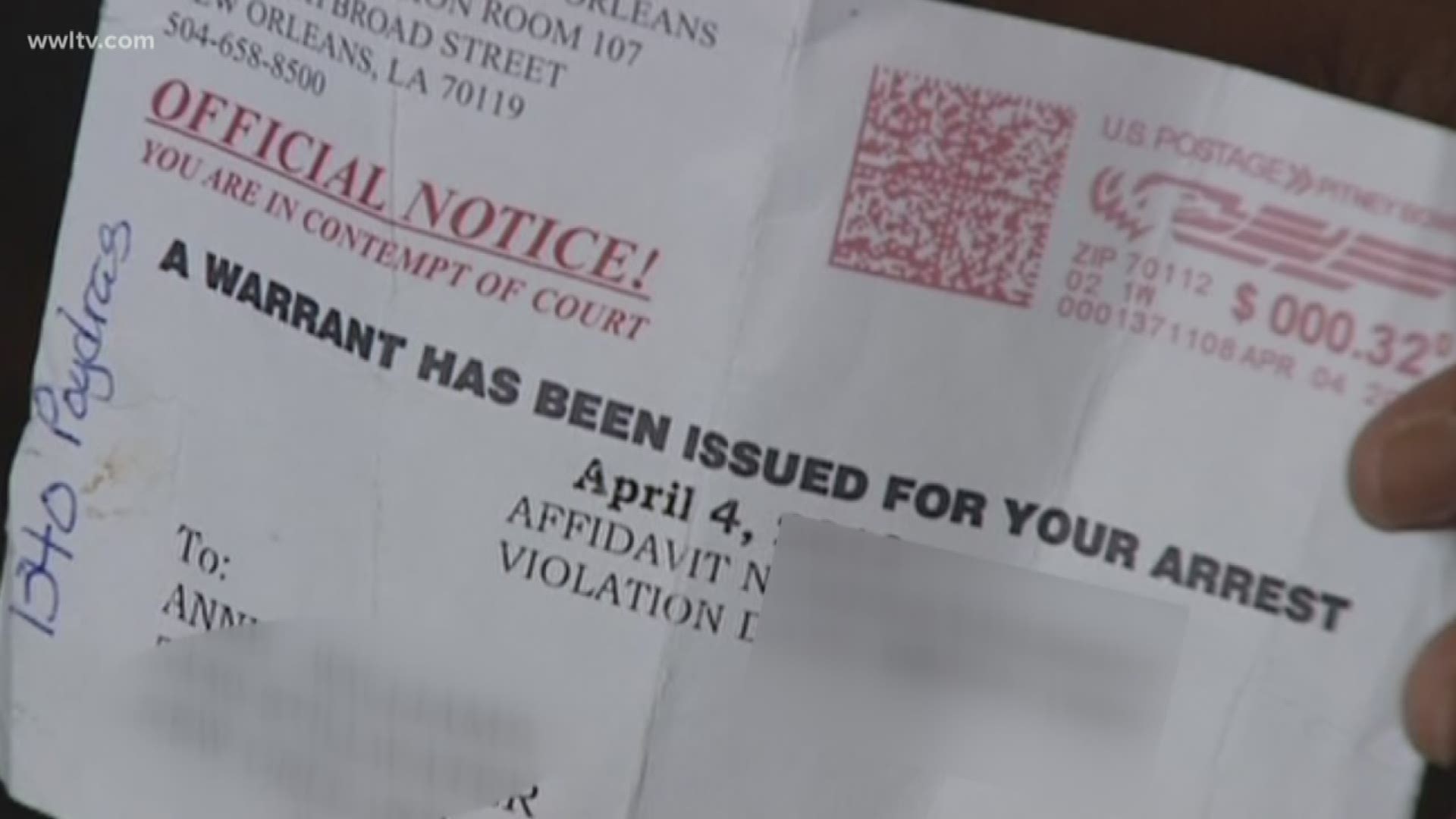

Legal Actions Associated

The PPP warrant list is closely linked to legal actions taken against individuals or entities involved in fraudulent activities. Federal authorities, including the Department of Justice, actively pursue legal action against those listed. These actions may include civil lawsuits, criminal charges, or both, depending on the severity of the fraud.

Types of Legal Actions

- Civil lawsuits for financial recovery.

- Criminal charges for intentional fraud.

- Settlement agreements in certain cases.

Understanding the legal implications of being on the PPP warrant list is crucial for businesses to protect themselves and avoid potential pitfalls.

How to Check PPP Warrant List

Businesses and individuals can check the PPP warrant list by accessing official government websites or contacting relevant federal authorities. The Small Business Administration (SBA) and the Department of Justice provide resources and updates on the list's contents.

Steps to Check PPP Warrant List

- Visit the official SBA website for updates.

- Search for specific names or entities using online databases.

- Contact federal authorities for detailed information.

Regularly checking the PPP warrant list can help businesses stay informed and address any potential issues proactively.

Preventing Fraud in PPP

Preventing fraud in the PPP program requires a multi-faceted approach involving both businesses and federal authorities. Businesses must ensure transparency in their financial dealings and maintain accurate records. Additionally, federal authorities must continue to enhance their investigative capabilities and implement stricter regulations.

Strategies for Preventing Fraud

- Implementing robust financial controls within businesses.

- Conducting regular audits and reviews of financial records.

- Enhancing investigative tools and technologies.

By adopting these strategies, businesses can contribute to the program's integrity and avoid potential legal complications.

Statistics and Data

According to recent data, the PPP program disbursed over $800 billion in loans to millions of small businesses. However, investigations revealed that a significant portion of these funds were misused or fraudulently obtained. The PPP warrant list has grown steadily, reflecting the ongoing efforts to address these issues.

Key Statistics

- Over $800 billion disbursed in PPP loans.

- Thousands of individuals and entities listed on the warrant list.

- Continued investigations uncovering new cases of fraud.

These statistics highlight the importance of addressing fraud in the PPP program and the need for continuous vigilance.

Conclusion

In conclusion, the PPP warrant list plays a critical role in ensuring transparency and accountability in the Paycheck Protection Program. By identifying fraudulent activities, the list helps protect taxpayer funds and maintain the program's integrity. Businesses must stay informed about the list's contents and updates to avoid potential legal complications.

We encourage readers to share this article and explore related content for further insights. If you have any questions or comments, feel free to leave them below. Stay compliant, stay informed, and contribute to the program's success.