The concept of a Beagle 401k might sound intriguing, but it represents a unique approach to retirement savings that combines traditional financial strategies with innovative ideas tailored for modern investors. As retirement planning becomes increasingly important, understanding the nuances of a Beagle 401k can significantly enhance your financial security. This guide will delve deep into the concept, exploring its benefits, drawbacks, and implementation strategies.

In today's fast-paced world, retirement planning is no longer an optional consideration but a necessity. With the rise in life expectancy and the ever-increasing cost of living, ensuring financial stability during your golden years has never been more critical. A Beagle 401k offers a fresh perspective on how individuals can prepare for their future, making it a topic worth exploring in detail.

This article aims to provide a comprehensive overview of Beagle 401k, addressing its core principles, advantages, and how it can be integrated into your financial strategy. Whether you're a seasoned investor or just beginning your journey toward retirement, this guide will equip you with the knowledge needed to make informed decisions.

Read also:Exploring The World Of Belowdeck A Journey Through The High Seas

Table of Contents

- Introduction to Beagle 401k

- The History and Evolution of Beagle 401k

- Key Benefits of Beagle 401k

- Comparing Beagle 401k with Traditional Plans

- How to Implement a Beagle 401k

- Understanding the Risks Involved

- Tax Implications of Beagle 401k

- Strategies for Maximizing Your Beagle 401k

- The Future of Beagle 401k

- Conclusion and Call to Action

Introduction to Beagle 401k

A Beagle 401k is essentially a retirement savings plan designed to provide individuals with a structured approach to saving for their future. It combines the flexibility of modern investment options with the security of traditional retirement accounts. This hybrid model allows participants to tailor their savings strategies to meet their specific needs and goals.

Why Choose Beagle 401k?

One of the primary reasons individuals opt for a Beagle 401k is its adaptability. Unlike conventional 401k plans, it offers a wider range of investment options, allowing participants to diversify their portfolios effectively. Additionally, it often includes features such as automatic contribution escalation and employer matching contributions, enhancing its appeal.

Who Can Benefit from Beagle 401k?

While Beagle 401k plans are suitable for a broad audience, they are particularly beneficial for young professionals and those seeking to maximize their retirement savings. The ability to adjust contributions and investment strategies makes it an ideal choice for individuals at various stages of their careers.

The History and Evolution of Beagle 401k

The origins of the Beagle 401k trace back to the early 2000s when financial experts began exploring ways to enhance traditional retirement plans. Over the years, this innovative approach has evolved, incorporating advancements in technology and financial strategies to better serve modern investors.

Key Milestones in Development

- 2002: Initial concept introduced by financial advisors.

- 2010: Integration of digital platforms for easier management.

- 2020: Expansion of investment options and increased accessibility.

Key Benefits of Beagle 401k

One of the standout features of a Beagle 401k is its numerous benefits, which cater to a wide array of investor needs. These advantages include:

Flexibility in Investment Choices

Participants have access to a diverse range of investment options, enabling them to create a portfolio that aligns with their risk tolerance and financial goals.

Read also:Exploring The Enigmatic Relationships Of David Bowie A Look At His Exgirlfriends

Enhanced Employer Contributions

Many Beagle 401k plans offer generous employer matching contributions, effectively increasing the total amount saved for retirement.

Automatic Contribution Adjustments

Features like automatic contribution escalation help individuals steadily increase their savings over time, ensuring they stay on track with their retirement objectives.

Comparing Beagle 401k with Traditional Plans

While Beagle 401k shares similarities with traditional retirement plans, it also offers distinct advantages. Understanding these differences can help individuals make informed decisions about their financial futures.

Similarities

- Both plans provide tax advantages.

- They offer employer contributions as an incentive.

Differences

- Beagle 401k typically includes more investment options.

- It often features advanced tools for managing contributions.

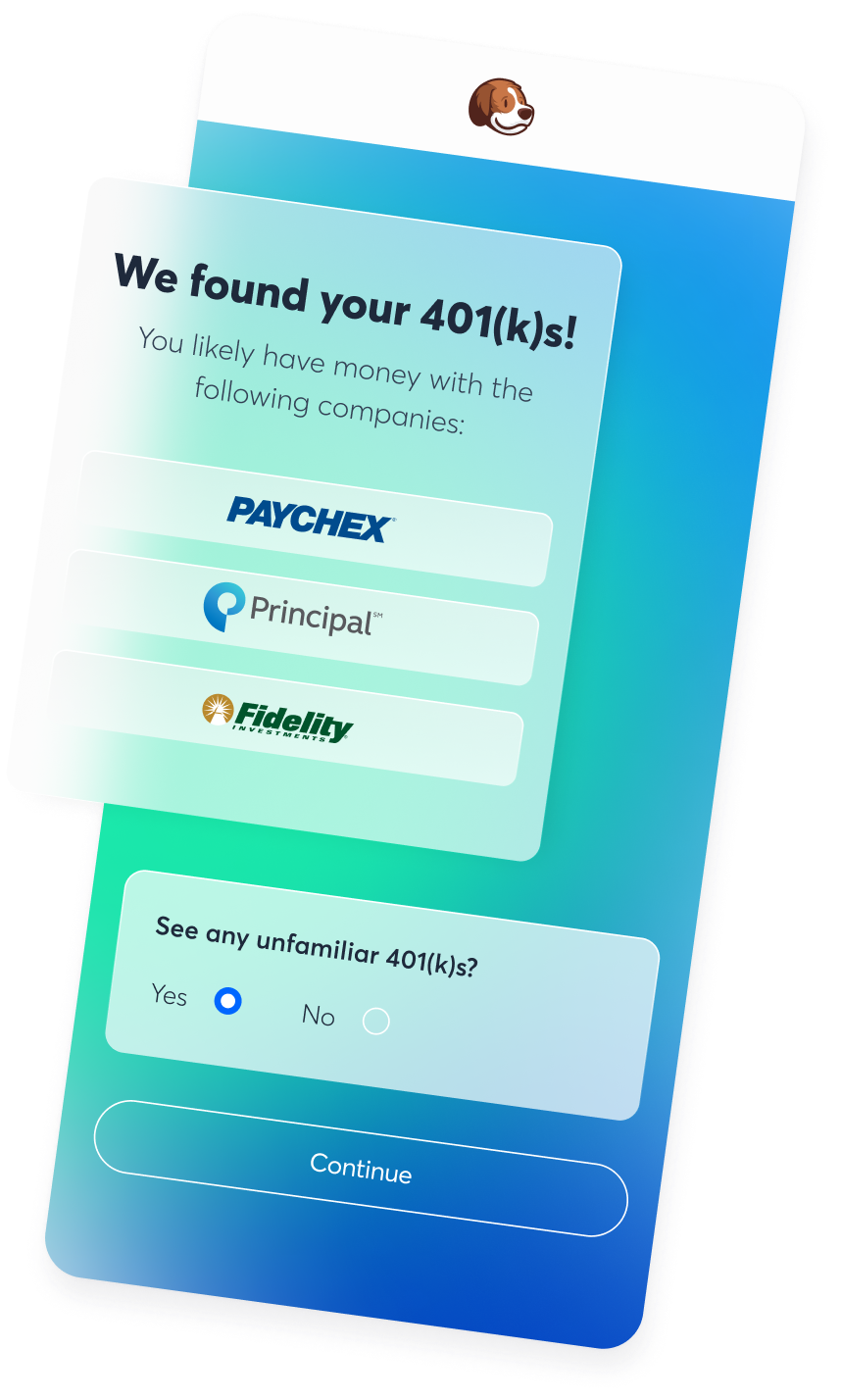

How to Implement a Beagle 401k

Setting up a Beagle 401k involves several steps, each crucial to ensuring the plan's success. From selecting the right provider to determining contribution levels, careful planning is essential.

Choosing the Right Provider

Researching and selecting a reputable provider is the first step in implementing a Beagle 401k. Factors such as fees, available investment options, and customer service should all be considered.

Determining Contribution Levels

Deciding on appropriate contribution levels is vital for maximizing the benefits of a Beagle 401k. Participants should aim to contribute enough to take full advantage of employer matching contributions while also considering their current financial situation.

Understanding the Risks Involved

Like any investment, a Beagle 401k carries certain risks. It's important for participants to be aware of these potential pitfalls and take steps to mitigate them.

Market Volatility

Investment options within a Beagle 401k are subject to market fluctuations, which can impact the overall value of the account. Diversifying investments can help reduce this risk.

Fee Structures

Understanding the fee structure associated with a Beagle 401k is crucial. High fees can erode returns over time, so it's important to choose a plan with reasonable costs.

Tax Implications of Beagle 401k

Taxes play a significant role in the effectiveness of a Beagle 401k. Knowing how contributions, withdrawals, and other aspects of the plan are taxed can help participants optimize their savings.

Contribution Limits

The IRS sets annual contribution limits for Beagle 401k plans, which participants must adhere to. These limits are subject to change, so staying informed is essential.

Withdrawal Rules

Understanding the rules governing withdrawals from a Beagle 401k is crucial for avoiding penalties. Participants should familiarize themselves with the requirements for penalty-free withdrawals and required minimum distributions.

Strategies for Maximizing Your Beagle 401k

Maximizing the benefits of a Beagle 401k requires strategic planning and ongoing management. Implementing the following strategies can help participants achieve their retirement goals.

Regularly Reviewing and Adjusting Contributions

Periodically reviewing and adjusting contribution levels ensures participants are on track with their retirement savings objectives.

Diversifying Investments

Diversification is key to managing risk within a Beagle 401k. Participants should consider spreading their investments across various asset classes to create a balanced portfolio.

The Future of Beagle 401k

As financial technology continues to evolve, the future of Beagle 401k looks promising. Advances in artificial intelligence and machine learning are likely to enhance the capabilities of these plans, offering participants even more sophisticated tools for managing their retirement savings.

Potential Innovations

Future innovations may include enhanced predictive analytics, personalized investment recommendations, and more seamless integration with other financial accounts.

Conclusion and Call to Action

In conclusion, a Beagle 401k represents a powerful tool for securing your financial future. By understanding its benefits, risks, and implementation strategies, you can make informed decisions about your retirement savings. We encourage you to take action by exploring the options available and considering how a Beagle 401k can fit into your overall financial plan.

Feel free to leave your thoughts and questions in the comments section below. Additionally, we invite you to share this article with others who may benefit from its insights and explore more resources on our website.