In today's fast-paced digital world, managing payments has become easier than ever thanks to innovative solutions like Metro Pay Bill. Whether you're paying utility bills, managing subscriptions, or handling other financial obligations, Metro Pay Bill offers a seamless and secure platform to handle all your payment needs.

As technology continues to evolve, more people are turning to online payment systems to simplify their financial lives. With Metro Pay Bill, users can enjoy a user-friendly interface, enhanced security features, and effortless transaction processing. This guide will walk you through everything you need to know about Metro Pay Bill, ensuring you make the most of this valuable service.

From setting up your account to troubleshooting common issues, we'll cover every aspect of Metro Pay Bill in detail. By the end of this article, you'll have a clear understanding of how this platform works and why it's an essential tool for modern money management.

Read also:Lorenzo Zurzolo Unveiling The Layers Of His Sexuality

Table of Contents

- What is Metro Pay Bill?

- Benefits of Using Metro Pay Bill

- How to Sign Up for Metro Pay Bill

- Payment Options Available

- Security Features

- Common Questions About Metro Pay Bill

- Integrating Metro Pay Bill with Other Services

- Tips for Maximizing Your Experience

- Troubleshooting Common Issues

- Future of Digital Payments

What is Metro Pay Bill?

Metro Pay Bill is a cutting-edge digital payment platform designed to streamline the process of paying bills and managing financial transactions. This service allows users to pay for utilities, subscriptions, loans, and more, all from a single, easy-to-use interface. By leveraging advanced technology and secure protocols, Metro Pay Bill ensures that your transactions are both efficient and protected.

How Does Metro Pay Bill Work?

Using Metro Pay Bill is straightforward. After creating an account, users can link their bank accounts or credit/debit cards to the platform. From there, they can schedule payments, set up automatic bill payments, and monitor their transaction history in real-time. The platform also sends reminders for upcoming payments, helping users stay organized and avoid late fees.

Benefits of Using Metro Pay Bill

There are numerous advantages to using Metro Pay Bill, making it an attractive option for individuals and businesses alike.

1. Convenience

Metro Pay Bill eliminates the hassle of manually paying bills by offering a centralized platform for all your payment needs. You can pay your bills anytime, anywhere, using your smartphone, tablet, or computer.

2. Security

With advanced encryption and two-factor authentication, Metro Pay Bill ensures that your financial information remains safe and secure. The platform adheres to industry standards for data protection, giving users peace of mind.

3. Cost-Effective

Many traditional payment methods come with hidden fees and charges. Metro Pay Bill offers transparent pricing, often eliminating unnecessary costs associated with bill payments.

Read also:Unraveling The Life Of Keith Papini A Journey Through Mystery And Controversy

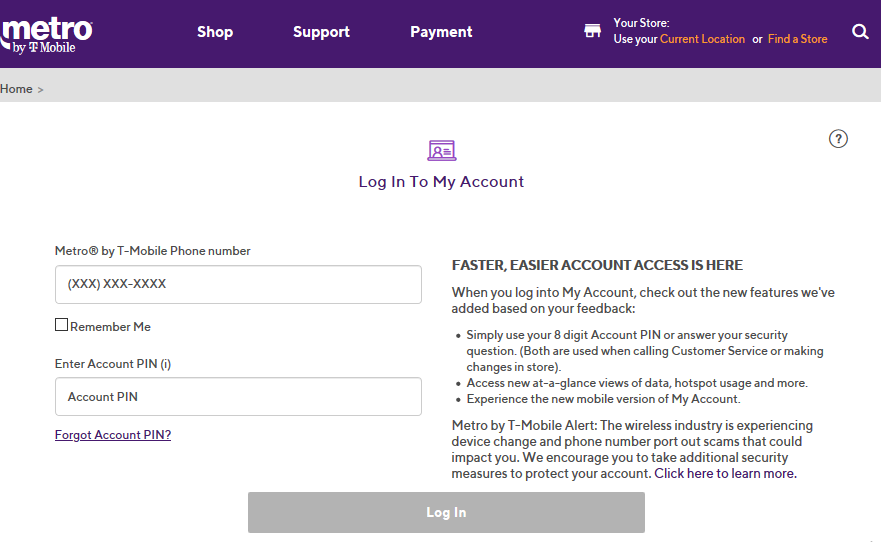

How to Sign Up for Metro Pay Bill

Signing up for Metro Pay Bill is a simple process that can be completed in just a few minutes. Follow these steps to get started:

- Visit the official Metro Pay Bill website or download the mobile app.

- Click on the "Sign Up" button and enter your personal information, such as name, email address, and phone number.

- Create a strong password and verify your account through email or SMS.

- Link your bank account or credit/debit card to the platform.

- Start using Metro Pay Bill to manage your payments.

Payment Options Available

Metro Pay Bill supports a wide range of payment methods, ensuring that users can choose the option that best suits their needs. Below are some of the payment options available on the platform:

Bank Transfers

Users can link their bank accounts to Metro Pay Bill and transfer funds directly from their accounts to pay bills. This method is often free and provides a seamless payment experience.

Credit/Debit Cards

For those who prefer using cards, Metro Pay Bill accepts major credit and debit cards, including Visa, Mastercard, and American Express. This option is ideal for users who want to earn rewards or benefits from their card issuers.

E-Wallets

Metro Pay Bill also integrates with popular e-wallets, allowing users to make payments using their digital wallets. This method is fast, convenient, and widely accepted across various platforms.

Security Features

Security is a top priority for Metro Pay Bill. The platform employs several advanced features to protect user data and transactions:

- Encryption Technology: All data transmitted through the platform is encrypted using industry-standard protocols.

- Two-Factor Authentication: Users can enable two-factor authentication to add an extra layer of security to their accounts.

- Fraud Detection: Metro Pay Bill utilizes sophisticated algorithms to detect and prevent fraudulent activities in real-time.

Common Questions About Metro Pay Bill

Here are some frequently asked questions about Metro Pay Bill:

Is Metro Pay Bill Safe to Use?

Yes, Metro Pay Bill is a secure platform that uses advanced encryption and fraud detection technologies to protect user data and transactions.

Can I Pay International Bills Using Metro Pay Bill?

Currently, Metro Pay Bill supports domestic bill payments. However, the platform is expanding its services to include international payments in the near future.

Integrating Metro Pay Bill with Other Services

Metro Pay Bill can be integrated with various financial services and tools, enhancing its functionality and usability. Some popular integrations include:

Accounting Software

Users can connect Metro Pay Bill with accounting software like QuickBooks or Xero to streamline their financial management processes.

Customer Relationship Management (CRM) Systems

Businesses can integrate Metro Pay Bill with their CRM systems to automate billing and payment collection, improving efficiency and customer satisfaction.

Tips for Maximizing Your Experience

To get the most out of Metro Pay Bill, consider the following tips:

- Set up automatic payments for recurring bills to avoid late fees.

- Monitor your transaction history regularly to ensure accuracy and detect any unauthorized activities.

- Take advantage of the platform's reminders to stay on top of upcoming payments.

Troubleshooting Common Issues

While Metro Pay Bill is designed to be user-friendly, users may occasionally encounter issues. Here are some common problems and their solutions:

Failed Payment

If a payment fails, check your account balance, ensure the correct payment method is selected, and verify that the biller information is accurate.

Account Lockout

If you're locked out of your account, reset your password or contact Metro Pay Bill's customer support for assistance.

Future of Digital Payments

As technology continues to advance, the future of digital payments looks promising. Innovations such as blockchain, artificial intelligence, and biometric authentication are expected to revolutionize the way we manage our finances. Metro Pay Bill is at the forefront of these developments, continuously improving its platform to meet the evolving needs of its users.

Emerging Trends in Digital Payments

Some emerging trends in digital payments include:

- Increased adoption of contactless payments.

- Growth of peer-to-peer payment platforms.

- Integration of AI-driven financial management tools.

Conclusion

Metro Pay Bill is a powerful tool for simplifying bill payments and managing financial transactions. With its user-friendly interface, robust security features, and wide range of payment options, it's no wonder that more and more people are choosing Metro Pay Bill to handle their payment needs.

To make the most of this platform, be sure to follow the tips outlined in this guide and stay informed about the latest developments in digital payments. We encourage you to share this article with others who may benefit from it and leave a comment below if you have any questions or feedback.

Stay tuned for more informative content on personal finance, technology, and lifestyle topics. Thank you for reading!