In today's digital age, partnerships between financial institutions and e-commerce giants are becoming increasingly common. Synchrony Bank Amazon is a prime example of such collaboration, where Synchrony Bank powers Amazon's credit card offerings. This partnership brings immense benefits to both parties and their customers. If you're curious about how this relationship works and what it means for you, this article will provide all the information you need.

As one of the leading private-label credit card issuers in the United States, Synchrony Bank has established itself as a trusted financial partner for major retail brands. Their collaboration with Amazon has set a new benchmark in the industry, offering consumers access to exclusive benefits, rewards, and financing options.

This article delves into the Synchrony Bank Amazon partnership, exploring its history, features, benefits, and how it impacts consumers. Whether you're an existing cardholder or considering applying for one of these cards, you'll find valuable insights here to help you make informed decisions.

Read also:Unveiling The Life And Legacy Of Jacob Payne

Table of Contents

- Introduction to Synchrony Bank and Amazon Partnership

- History of Synchrony Bank Amazon Collaboration

- Synchrony Bank Amazon Credit Cards Overview

- Benefits of Synchrony Bank Amazon Credit Cards

- Reward Programs and Perks

- Eligibility Criteria and Application Process

- Security Features and Fraud Protection

- Customer Support and Services

- Comparison with Other Retail Credit Cards

- Future of Synchrony Bank Amazon Partnership

Introduction to Synchrony Bank and Amazon Partnership

Synchrony Bank, a leading provider of private-label credit cards, has been at the forefront of innovative financial solutions for retailers. Their partnership with Amazon represents a significant milestone in the financial services industry. By combining Synchrony's expertise in credit card issuance with Amazon's vast customer base, the collaboration offers unparalleled value to consumers.

Why Synchrony Bank?

Synchrony Bank stands out due to its extensive experience in crafting tailored financial products for retailers. With a strong focus on customer satisfaction and cutting-edge technology, they ensure that their partners and cardholders enjoy seamless transactions and robust security features.

Amazon's Role in the Partnership

Amazon, as the world's largest online retailer, leverages Synchrony Bank's capabilities to enhance its financial offerings. Together, they provide customers with access to exclusive credit cards that offer rewards, cashback, and financing options tailored to their shopping habits.

History of Synchrony Bank Amazon Collaboration

The partnership between Synchrony Bank and Amazon dates back to the early 2000s. Initially, Synchrony provided financing solutions for Amazon's customers through installment loans. Over the years, the collaboration evolved to include credit card offerings, which have become increasingly popular among Amazon shoppers.

Key Milestones

- 2003: Synchrony begins offering financing solutions for Amazon customers.

- 2012: Launch of the Amazon Rewards Visa Card by Synchrony Bank.

- 2018: Introduction of the Amazon Prime Rewards Visa Signature Card.

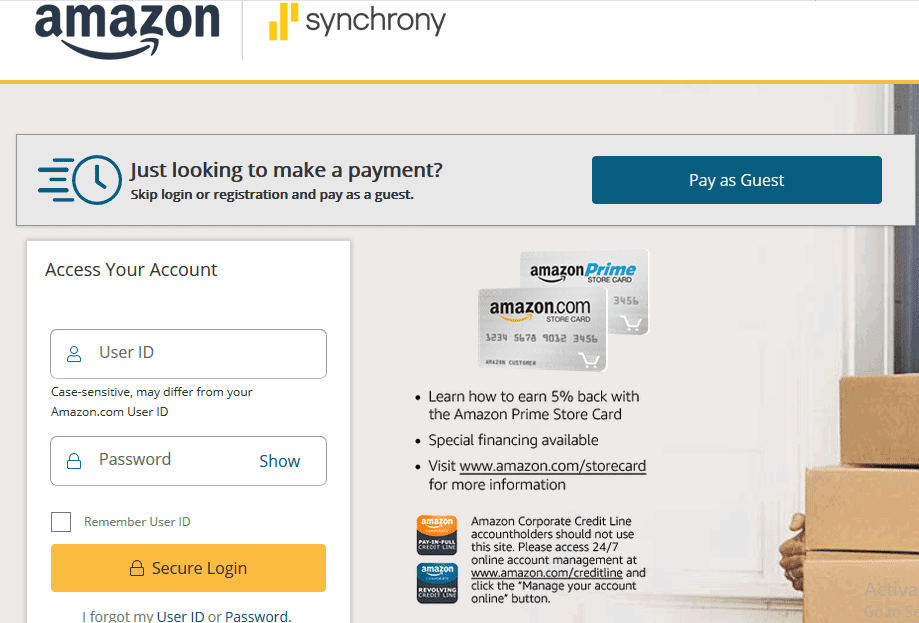

Synchrony Bank Amazon Credit Cards Overview

Synchrony Bank Amazon offers two primary credit cards: the Amazon Rewards Visa Card and the Amazon Prime Rewards Visa Signature Card. Both cards cater to different customer segments, providing tailored benefits and rewards.

Amazon Rewards Visa Card

This card is designed for everyday shoppers who frequently purchase items on Amazon. Cardholders earn 5% back on Amazon.com purchases, 2% back at gas stations, and 1% back on all other purchases.

Read also:Disha Salian Age Unveiling The Life Of A Rising Star

Amazon Prime Rewards Visa Signature Card

Exclusive to Amazon Prime members, this card offers enhanced rewards, including 6% back on Amazon.com purchases, 3% back at restaurants, gas stations, and drugstores, and 1% back on all other purchases.

Benefits of Synchrony Bank Amazon Credit Cards

Holding a Synchrony Bank Amazon credit card comes with numerous benefits that make it an attractive option for consumers. Below are some of the key advantages:

- Generous Rewards: Cardholders earn significant cashback on eligible purchases, making their shopping more rewarding.

- No Annual Fee: Both cards offer no annual fee, ensuring that customers maximize their savings.

- Exclusive Financing Options: Synchrony Bank provides special financing deals for Amazon purchases, allowing customers to pay over time with manageable payments.

Additional Benefits

In addition to cashback rewards, cardholders enjoy perks such as extended warranty coverage, purchase protection, and travel accident insurance. These benefits enhance the overall value proposition of the Synchrony Bank Amazon credit cards.

Reward Programs and Perks

Synchrony Bank Amazon credit cards boast robust reward programs that cater to the spending habits of Amazon shoppers. Below is a breakdown of the rewards offered by each card:

Amazon Rewards Visa Card

- 5% back on Amazon.com purchases.

- 2% back at gas stations.

- 1% back on all other purchases.

Amazon Prime Rewards Visa Signature Card

- 6% back on Amazon.com purchases.

- 3% back at restaurants, gas stations, and drugstores.

- 1% back on all other purchases.

These reward programs are designed to incentivize loyal Amazon shoppers while providing flexibility for other everyday expenses.

Eligibility Criteria and Application Process

Applying for a Synchrony Bank Amazon credit card is straightforward, but certain eligibility criteria must be met. Below are the key requirements and steps to apply:

Eligibility Criteria

- Must be at least 18 years old.

- Must have a valid Social Security Number or Individual Taxpayer Identification Number.

- Must demonstrate sufficient creditworthiness based on credit score and income.

Application Process

Applicants can apply for the credit card online through Amazon's website or by visiting Synchrony Bank's official portal. The application process typically takes a few minutes, and applicants receive an instant decision in most cases.

Security Features and Fraud Protection

Synchrony Bank prioritizes the security of its cardholders by implementing advanced fraud protection measures. Below are some of the key security features:

- Zero Liability Protection: Cardholders are not held liable for unauthorized transactions.

- Two-Factor Authentication: Enhanced security for online account access.

- 24/7 Monitoring: Real-time monitoring of transactions to detect suspicious activity.

These security features ensure that cardholders can shop with confidence, knowing their financial information is safeguarded.

Customer Support and Services

Synchrony Bank provides excellent customer support to address any concerns or inquiries from cardholders. Below are some of the services available:

- 24/7 Customer Service: Dedicated support team available around the clock.

- Online Account Management: Convenient access to account information and tools.

- Mobile App: Easy management of credit card accounts on the go.

These services enhance the overall customer experience, making it easier for cardholders to manage their finances effectively.

Comparison with Other Retail Credit Cards

When compared to other retail credit cards, Synchrony Bank Amazon credit cards stand out due to their generous rewards, no annual fee, and strong security features. Below is a comparison table highlighting key differences:

| Feature | Synchrony Bank Amazon | Other Retail Cards |

|---|---|---|

| Rewards Rate | Up to 6% back on Amazon.com purchases | Typically 1-3% back |

| Annual Fee | No annual fee | Some cards charge annual fees |

| Security Features | Advanced fraud protection | Varies by issuer |

This comparison underscores the competitive edge of Synchrony Bank Amazon credit cards in the retail credit card market.

Future of Synchrony Bank Amazon Partnership

The future of the Synchrony Bank Amazon partnership looks promising, with both companies committed to enhancing their offerings. Potential developments may include expanded reward programs, additional financing options, and improved customer service features.

Innovations on the Horizon

- Enhanced Mobile App: Upgraded functionality for managing credit card accounts.

- Increased Rewards: Higher cashback rates and more exclusive perks for cardholders.

- Expanded Financing Options: New installment plans for larger purchases.

These innovations will further solidify the partnership's position as a leader in the financial services industry.

Conclusion

The Synchrony Bank Amazon partnership represents a successful collaboration between a leading financial institution and the world's largest online retailer. By offering generous rewards, robust security features, and excellent customer support, these credit cards provide immense value to consumers. Whether you're an avid Amazon shopper or simply looking for a reliable credit card option, Synchrony Bank Amazon credit cards are worth considering.

We encourage you to explore the benefits of these cards and take advantage of the exclusive offers available. Don't forget to leave a comment below or share this article with your friends and family. For more insightful content, be sure to check out our other articles on financial topics.