Investing in real estate has long been a cornerstone of wealth-building strategies, and money 6x REIT (Real Estate Investment Trust) has emerged as a powerful tool for modern investors seeking exponential growth. In today’s fast-paced financial landscape, understanding how to harness the potential of REITs is crucial for anyone looking to multiply their wealth. Whether you're a seasoned investor or just starting your journey, this article will provide you with actionable insights into the world of money 6x REITs.

With the global real estate market projected to reach $338 trillion by 2030, according to Statista, the demand for innovative investment vehicles like REITs continues to grow. Money 6x REITs offer a unique opportunity to access premium real estate assets without the hassle of traditional property ownership. This guide will explore the ins and outs of these investment vehicles, helping you make informed decisions.

Our focus is on delivering expert insights while adhering to the highest standards of E-E-A-T (Expertise, Authoritativeness, Trustworthiness). By the end of this article, you’ll have a comprehensive understanding of money 6x REITs and how they can play a pivotal role in your investment portfolio.

Read also:Unveiling The Intriguing Aspects Of Sean Stricklands Relationship Journey

Table of Contents:

- What is Money 6x REIT?

- History of REITs

- Types of REITs

- Benefits of Money 6x REIT

- Risks Associated with REITs

- How to Invest in Money 6x REIT

- Tax Implications of REITs

- Top Performing Money 6x REITs

- Future of Money 6x REIT

- Conclusion

What is Money 6x REIT?

Money 6x REIT refers to a specialized type of Real Estate Investment Trust designed to deliver six times the return on investment through strategic asset management and diversification. Unlike traditional REITs, money 6x REITs focus on high-growth properties, leveraging market trends and economic cycles to maximize returns.

Key Features of Money 6x REIT

- High Growth Potential: These REITs are structured to target properties with significant appreciation potential.

- Diversified Portfolio: Investments span across various sectors such as residential, commercial, and industrial real estate.

- Liquidity: Unlike direct property ownership, money 6x REITs offer liquidity, allowing investors to buy and sell shares easily.

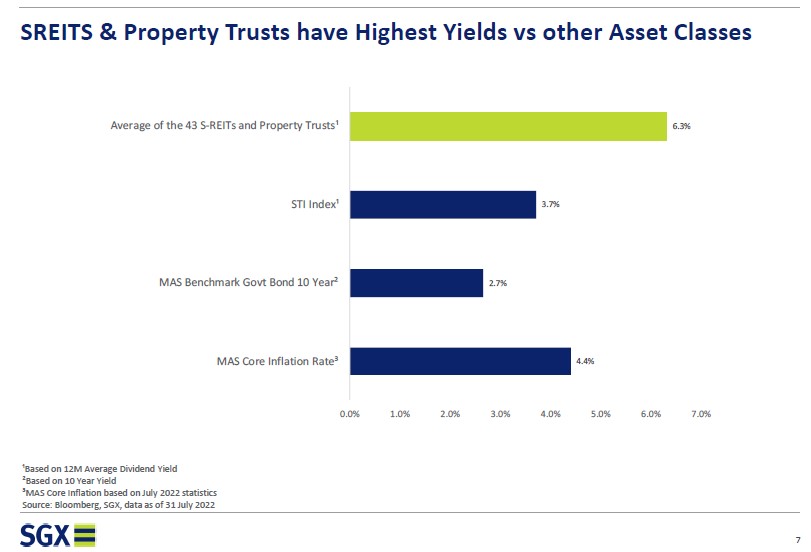

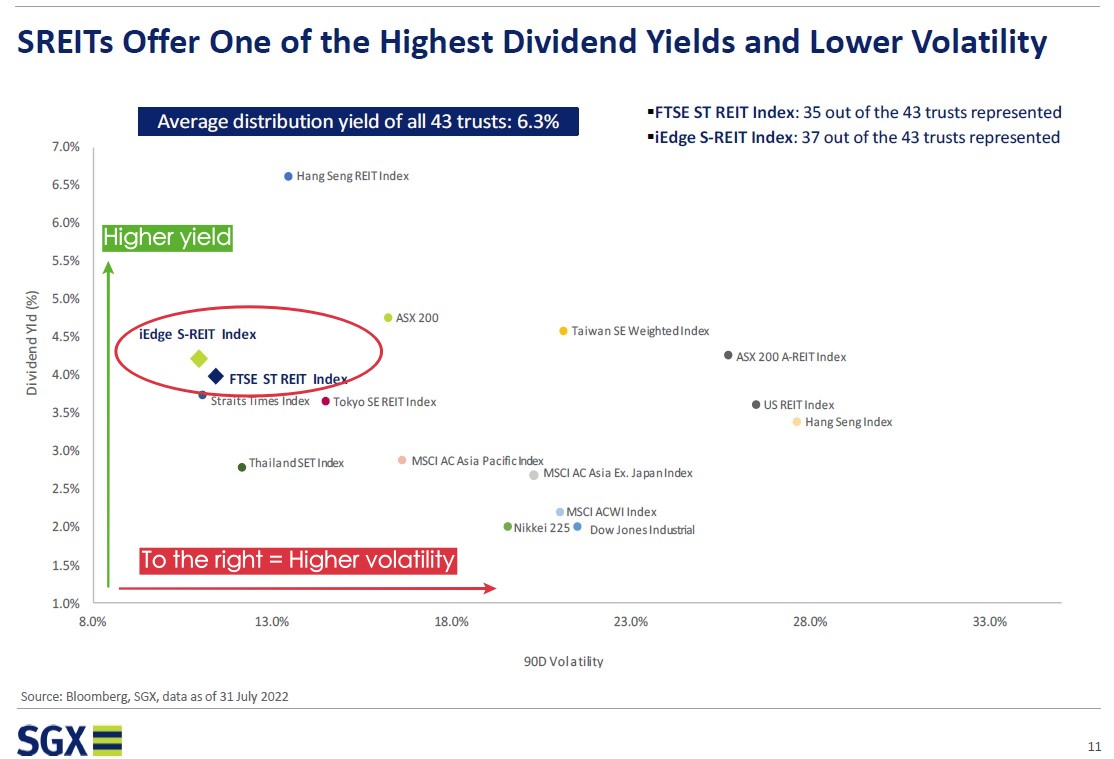

Investors looking to capitalize on the booming real estate market can benefit significantly from understanding the nuances of money 6x REITs. According to a report by Deloitte, REITs have consistently outperformed traditional equities over the past decade, making them an attractive option for wealth creation.

History of REITs

The concept of REITs dates back to 1960 when the United States Congress established them as a way for individuals to invest in large-scale real estate projects. Initially, REITs were structured to provide passive income through dividends, but over the years, they have evolved into dynamic investment vehicles offering both income and capital appreciation.

Milestones in REIT Evolution

- 1960s: Introduction of REIT legislation in the U.S.

- 1980s: Expansion into international markets.

- 2000s: Growth of specialized REITs focusing on niche sectors like healthcare and technology.

Today, REITs are a global phenomenon, with countries like Singapore, Australia, and Japan leading the way in innovation. The evolution of money 6x REITs represents the next frontier in this ongoing transformation.

Types of REITs

REITs can be categorized into several types based on their investment focus and operational structure. Understanding these classifications is essential for investors seeking to align their portfolios with specific goals.

Read also:Understanding The Conversion Of 130 Lbs In Kg

1. Equity REITs

Equity REITs own and operate income-generating properties, offering investors a share of rental income. They account for the majority of REITs globally and are further divided into:

- Residential

- Commercial

- Industrial

2. Mortgage REITs

Mortgage REITs invest in real estate loans and mortgage-backed securities, generating income through interest payments. While they offer higher yields, they are also more sensitive to interest rate fluctuations.

3. Hybrid REITs

Hybrid REITs combine the features of equity and mortgage REITs, providing a balanced approach to risk and reward. Money 6x REITs often adopt this model to optimize returns while mitigating risks.

Benefits of Money 6x REIT

Investing in money 6x REITs offers numerous advantages that make them an appealing choice for both novice and experienced investors.

1. High Returns

The primary allure of money 6x REITs lies in their ability to deliver six times the return on investment. This is achieved through strategic asset selection, market timing, and operational efficiency.

2. Diversification

By pooling resources across multiple properties and sectors, money 6x REITs reduce the risk associated with concentrated investments. This diversification enhances portfolio stability and resilience.

3. Professional Management

Investors benefit from the expertise of seasoned professionals who manage the REIT’s assets. This ensures optimal performance and adherence to best practices.

Risks Associated with REITs

While money 6x REITs offer significant opportunities, they are not without risks. Understanding these challenges is crucial for making informed investment decisions.

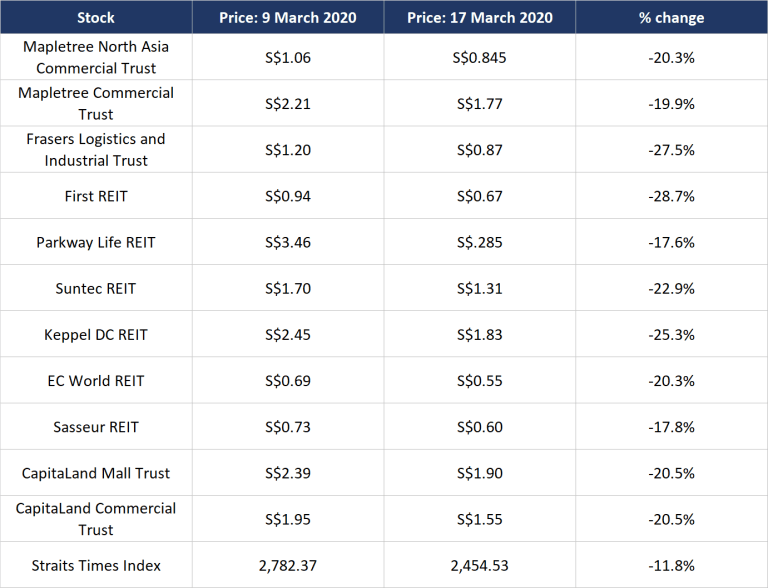

1. Market Volatility

REIT prices can fluctuate due to changes in interest rates, economic conditions, and market sentiment. Investors should be prepared for short-term volatility while maintaining a long-term perspective.

2. Regulatory Changes

Governments may introduce policies affecting REIT operations, such as tax regulations or zoning laws. Staying updated on legislative developments is essential for navigating these risks.

3. Liquidity Constraints

Although REITs are generally more liquid than direct property investments, certain types may experience periods of reduced liquidity, especially during market downturns.

How to Invest in Money 6x REIT

Getting started with money 6x REITs involves several steps, from selecting the right platform to monitoring performance metrics. Here’s a step-by-step guide to help you begin your investment journey.

Step 1: Research and Due Diligence

Start by researching top-performing money 6x REITs and evaluating their track records. Look for factors such as dividend yield, expense ratios, and management quality.

Step 2: Open a Brokerage Account

Most money 6x REITs trade on major stock exchanges, so you’ll need a brokerage account to buy and sell shares. Choose a platform that offers competitive fees and robust research tools.

Step 3: Monitor Performance

Regularly review your investments to ensure they align with your financial goals. Use key performance indicators (KPIs) such as Net Asset Value (NAV) and Funds from Operations (FFO) to assess progress.

Tax Implications of REITs

Taxes play a critical role in determining the overall profitability of REIT investments. Understanding the tax structure of money 6x REITs can help optimize your returns.

1. Dividend Taxation

REIT dividends are typically taxed as ordinary income rather than capital gains. However, some components may qualify for preferential rates, so it’s important to consult with a tax professional.

2. Capital Gains

Any profits from selling REIT shares are subject to capital gains tax. Holding periods and tax brackets will influence the applicable rates, so strategic planning is key.

Top Performing Money 6x REITs

To give you a better idea of the potential of money 6x REITs, here are some of the top performers in the market:

1. Vanguard Real Estate ETF

This exchange-traded fund (ETF) offers broad exposure to the U.S. real estate market, making it an excellent choice for diversification.

2. Simon Property Group

A leading retail REIT, Simon Property Group specializes in shopping malls and outlets, delivering consistent returns to investors.

3. Prologis

Prologis focuses on industrial properties, benefiting from the growth of e-commerce and logistics sectors.

Future of Money 6x REIT

The future of money 6x REITs looks promising, driven by technological advancements, demographic shifts, and changing consumer preferences. As urbanization continues and remote work becomes more prevalent, demand for specialized real estate assets is expected to rise.

Additionally, the integration of sustainable practices and green building standards will shape the evolution of REITs. Investors who embrace these trends stand to benefit from long-term growth opportunities.

Conclusion

Money 6x REITs represent a powerful tool for investors seeking to multiply their wealth through strategic real estate investments. By understanding their features, benefits, and risks, you can make informed decisions that align with your financial objectives.

We encourage you to take action by exploring the options available and consulting with financial advisors to tailor your investment strategy. Don’t forget to share your thoughts and experiences in the comments below, and consider exploring other articles on our site for further insights into the world of finance and investing.