PPP loans warrant list has become a significant topic of discussion in the financial and business sectors, particularly in the wake of the pandemic. The Paycheck Protection Program (PPP) was created to help small businesses survive financial challenges by providing forgivable loans. However, with the rise in demand and the complexities of the program, the warrant list has emerged as a crucial tool for transparency and accountability.

Understanding the intricacies of the PPP loans warrant list is essential for businesses seeking financial assistance. This list serves as a public record that sheds light on companies and individuals who have benefited from the PPP funds, ensuring that the program's objectives are met.

In this article, we will delve deep into the PPP loans warrant list, exploring its significance, how it works, and how businesses can navigate it effectively. Whether you're a small business owner or someone interested in the financial mechanisms supporting businesses, this guide will provide you with comprehensive insights.

Read also:Tina Turners Daughter The Legacy Continues

Table of Contents

- Introduction to PPP Loans Warrant List

- Overview of PPP Loans

- Understanding the Warrant List

- Eligibility Criteria for PPP Loans

- How to Apply for PPP Loans

- Loan Forgiveness Process

- Transparency in PPP Loans

- Challenges and Controversies

- The Future of PPP Loans

- Conclusion and Call to Action

Introduction to PPP Loans Warrant List

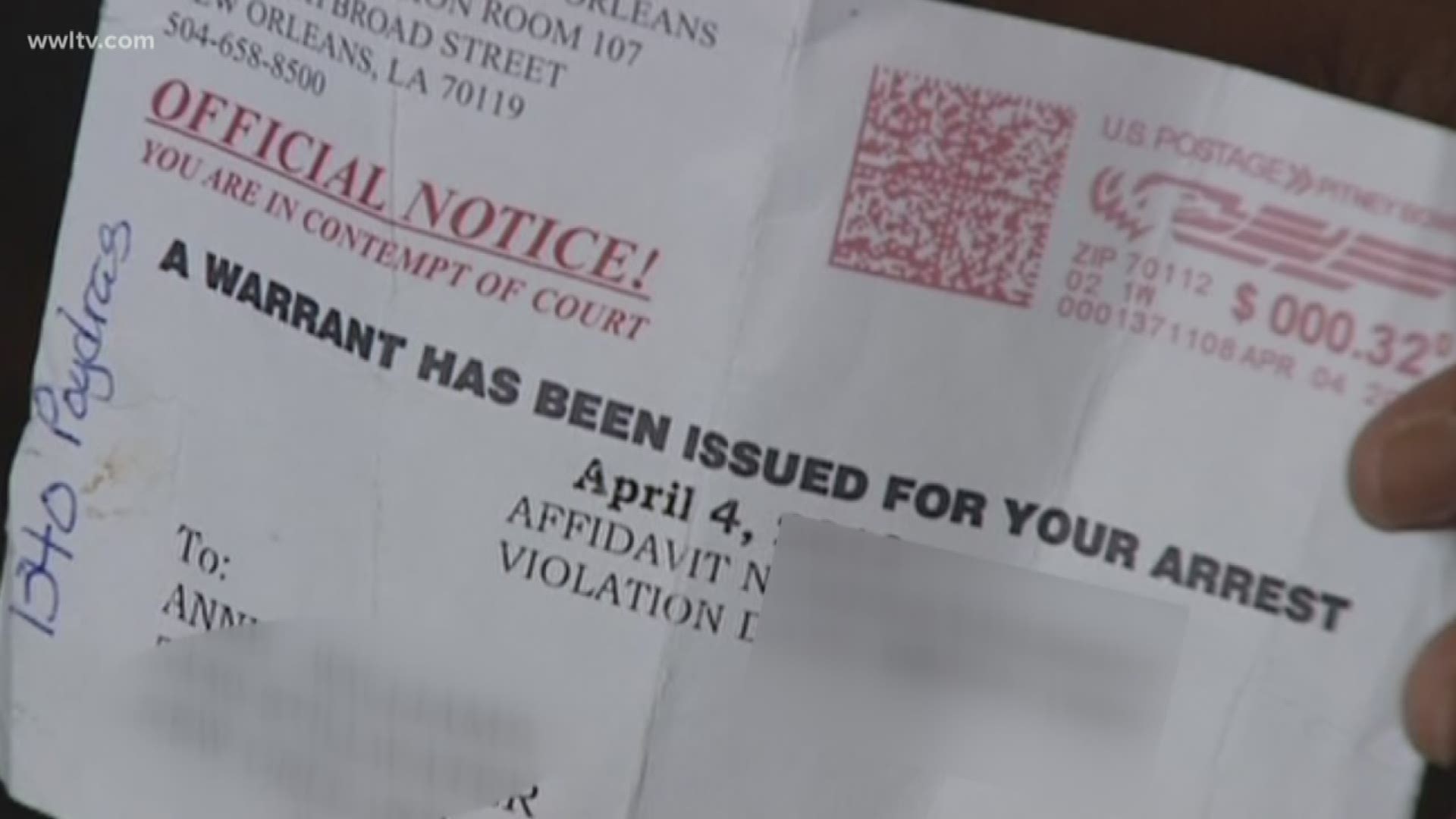

The PPP loans warrant list is a public database that tracks businesses and entities that have received PPP loans. This list is part of the broader effort to ensure transparency and accountability in the allocation of federal funds. It provides valuable insights into the types of businesses that have benefited from the program.

Why is the PPP Loans Warrant List Important?

The warrant list is crucial for several reasons:

- It promotes transparency by disclosing the recipients of PPP loans.

- It helps identify potential misuse or fraud in the program.

- It provides data for researchers and analysts to study the impact of PPP loans.

Overview of PPP Loans

PPP loans were introduced as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act in 2020. The program aimed to provide financial relief to small businesses affected by the pandemic. These loans are designed to cover payroll costs, rent, utilities, and other operational expenses.

Key Features of PPP Loans

Some of the key features of PPP loans include:

- Forgivable loans if certain conditions are met.

- Low-interest rates and no collateral requirements.

- Wide eligibility criteria to accommodate various types of businesses.

Understanding the Warrant List

The PPP loans warrant list is a comprehensive record of all businesses that have received PPP loans. It includes details such as the business name, loan amount, and location. This list is regularly updated to reflect new data and ensure accuracy.

How is the Warrant List Compiled?

The warrant list is compiled using data from the Small Business Administration (SBA) and participating lenders. It undergoes rigorous verification processes to ensure the authenticity of the information.

Read also:Exploring The Enigmatic Relationships Of David Bowie A Look At His Exgirlfriends

Eligibility Criteria for PPP Loans

Businesses must meet specific eligibility criteria to qualify for PPP loans. These criteria include:

- Having fewer than 500 employees.

- Experiencing financial hardship due to the pandemic.

- Using the loan for eligible expenses such as payroll and rent.

Who Can Apply?

Eligible applicants include small businesses, self-employed individuals, and certain nonprofit organizations. The SBA provides detailed guidelines to help businesses determine their eligibility.

How to Apply for PPP Loans

Applying for PPP loans involves several steps. Businesses must submit an application form along with supporting documentation to an approved lender. The lender will review the application and forward it to the SBA for final approval.

Tips for a Successful Application

- Prepare all required documentation in advance.

- Clearly outline how the loan will be used to support business operations.

- Work closely with your lender to ensure a smooth application process.

Loan Forgiveness Process

One of the most attractive features of PPP loans is the possibility of loan forgiveness. To qualify for forgiveness, businesses must meet specific requirements, such as spending a certain percentage of the loan on eligible expenses.

Steps to Achieve Loan Forgiveness

Businesses should:

- Track all expenses related to the PPP loan.

- Submit a forgiveness application to their lender.

- Provide detailed documentation to support their application.

Transparency in PPP Loans

Transparency is a cornerstone of the PPP program. The warrant list plays a vital role in ensuring that the public has access to information about how PPP funds are distributed. This transparency helps build trust and accountability in the program.

Benefits of Transparency

- Encourages ethical use of funds.

- Facilitates public oversight and scrutiny.

- Supports informed decision-making for policymakers.

Challenges and Controversies

Despite its many benefits, the PPP program has faced several challenges and controversies. Issues such as fraud, misallocation of funds, and discrepancies in the warrant list have raised concerns among stakeholders.

Addressing Challenges

To address these challenges, the SBA and other regulatory bodies have implemented stricter oversight measures. These include enhanced audits, increased penalties for fraud, and improved data verification processes.

The Future of PPP Loans

The future of PPP loans remains uncertain as the pandemic evolves. However, the program has demonstrated its effectiveness in supporting small businesses during times of crisis. Future iterations of the program may incorporate lessons learned to improve its efficiency and reach.

Potential Improvements

- Streamlined application processes.

- Enhanced transparency and accountability measures.

- Expanded eligibility criteria to include more businesses.

Conclusion and Call to Action

The PPP loans warrant list is a critical component of the PPP program, promoting transparency and accountability in the allocation of federal funds. Understanding its significance and navigating its complexities can help businesses make informed decisions about their financial future.

We encourage readers to explore the resources provided in this article and take advantage of the opportunities offered by the PPP program. Leave a comment below to share your thoughts or ask questions. Additionally, consider sharing this article with others who may benefit from its insights.

For more information on PPP loans and other financial assistance programs, visit our website regularly for updates and expert advice.

Data Source: Small Business Administration (SBA)