Investing in real estate investment trusts (REITs) has become one of the most popular ways to grow wealth and achieve financial freedom. Among the various REIT options available, the concept of "Money 6x REIT" stands out as a powerful strategy for maximizing returns. Whether you're a seasoned investor or just starting your journey, understanding this approach can significantly enhance your portfolio's performance.

Real estate has long been regarded as a stable and lucrative asset class. REITs allow individuals to invest in real estate without directly owning properties, offering liquidity and diversification benefits. The "Money 6x REIT" concept takes this investment strategy to the next level by focusing on high-yield, high-growth opportunities that can multiply your returns sixfold or more.

As we delve deeper into this topic, we will explore the fundamentals of REITs, the mechanics of the Money 6x REIT strategy, and actionable tips to help you succeed in the world of real estate investing. Let's get started!

Read also:Exploring The Enigmatic Relationships Of David Bowie A Look At His Exgirlfriends

Table of Contents

- What is Money 6x REIT?

- Understanding REITs

- Types of REITs

- The Money 6x REIT Strategy

- Benefits of Money 6x REIT

- Risks and Challenges

- How to Invest in Money 6x REIT

- Market Performance of Money 6x REIT

- Expert Insights on Money 6x REIT

- Conclusion

What is Money 6x REIT?

Money 6x REIT refers to a specific investment strategy aimed at achieving sixfold returns on your real estate investments through carefully selected REITs. This approach involves identifying high-performing REITs with strong growth potential, dividend yields, and market positioning. By leveraging these factors, investors can significantly boost their portfolio value over time.

The key to success lies in understanding the nuances of REITs and applying a disciplined investment strategy. In the following sections, we will break down the components of this approach and provide actionable insights for investors.

Understanding REITs

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-generating real estate. They provide investors with an opportunity to participate in the real estate market without the need for direct property ownership. REITs are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends, making them an attractive option for income-focused investors.

Key Characteristics of REITs

- Publicly traded on major stock exchanges

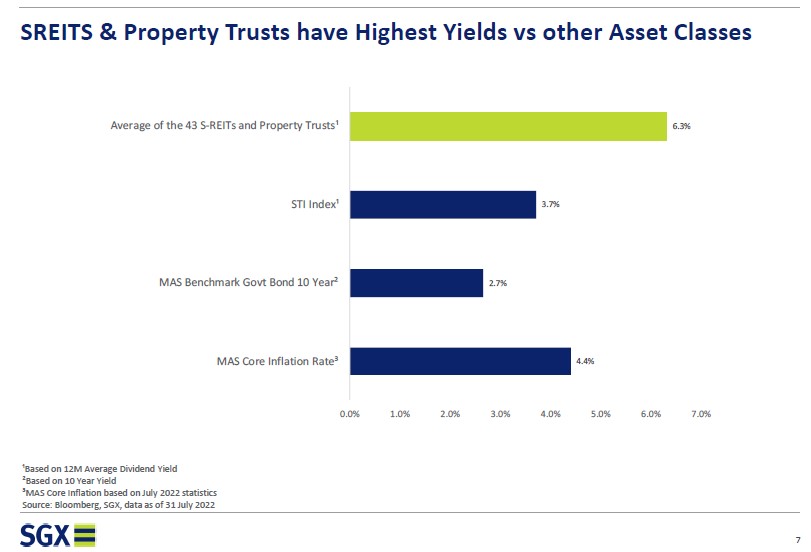

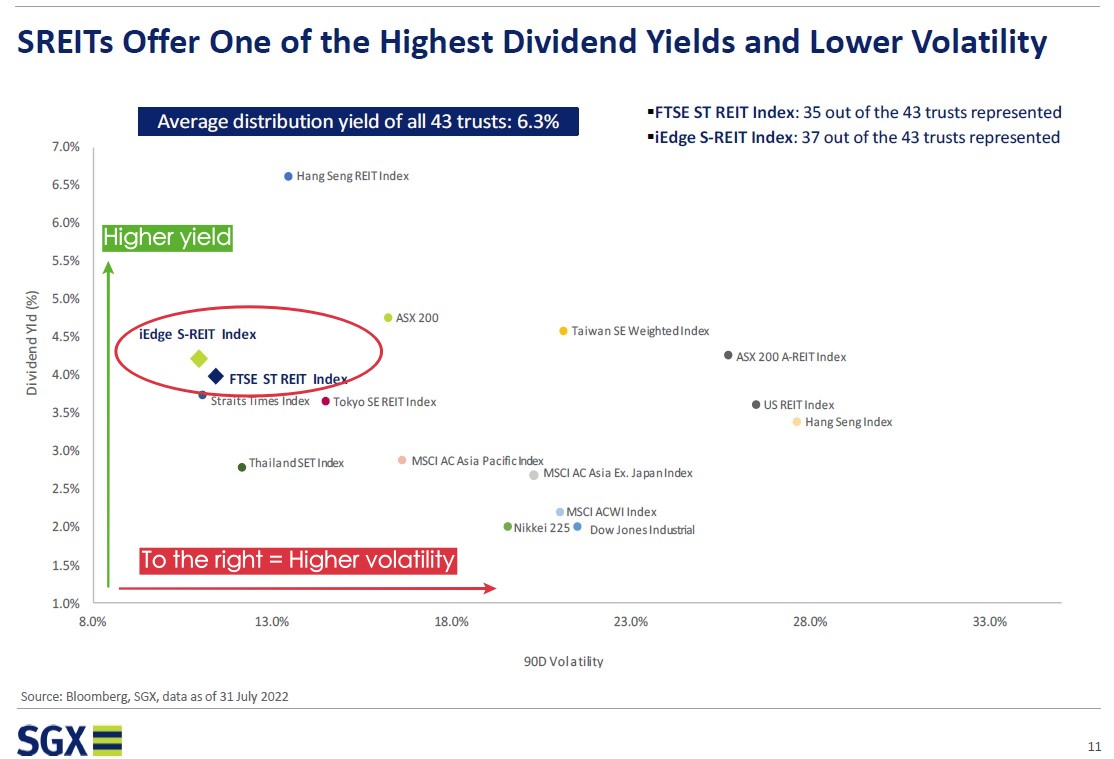

- High dividend yields compared to traditional stocks

- Diversification across various real estate sectors

- Professional management and operational expertise

Types of REITs

REITs come in various forms, each catering to different investment goals and risk tolerances. Understanding the different types of REITs is essential for building a well-rounded portfolio.

Equity REITs

Equity REITs own and operate income-producing properties such as office buildings, shopping malls, and residential complexes. They generate revenue primarily through rental income.

Mortgage REITs

Mortgage REITs invest in real estate loans and mortgage-backed securities. Their income comes from the interest earned on these investments.

Read also:Discovering Sy Kravitz The Place Of Birth And More

Hybrid REITs

Hybrid REITs combine the features of equity and mortgage REITs, offering a balanced approach to real estate investing.

The Money 6x REIT Strategy

The Money 6x REIT strategy focuses on identifying and investing in REITs with the potential to deliver sixfold returns. This involves a combination of fundamental analysis, market research, and strategic asset allocation.

Selecting the Right REITs

- Focus on REITs with strong historical performance

- Evaluate management quality and operational efficiency

- Consider market trends and economic factors

Building a Diversified Portfolio

A well-diversified portfolio can help mitigate risks and enhance returns. By spreading investments across different sectors and geographies, investors can capitalize on market opportunities while minimizing exposure to individual risks.

Benefits of Money 6x REIT

Investing in Money 6x REIT offers numerous advantages, including:

- High potential for capital appreciation

- Steady income generation through dividends

- Liquidity and ease of access through public markets

- Diversification across multiple real estate sectors

These benefits make Money 6x REIT an attractive option for both novice and experienced investors alike.

Risks and Challenges

While the Money 6x REIT strategy holds immense potential, it is not without risks. Investors must be aware of the challenges associated with this approach and take appropriate measures to mitigate them.

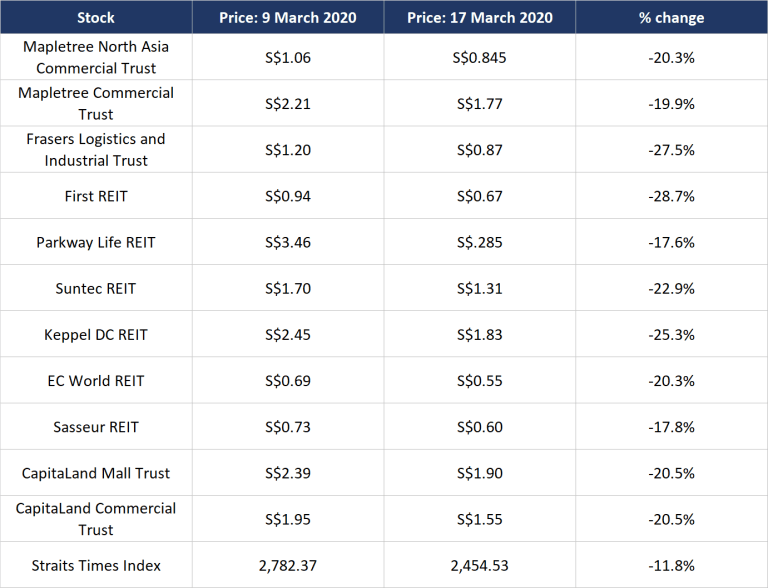

Market Volatility

REIT prices can fluctuate due to changes in interest rates, economic conditions, and geopolitical events. Staying informed and maintaining a long-term perspective can help navigate these challenges.

Interest Rate Sensitivity

REITs are particularly sensitive to interest rate changes, as higher rates can increase borrowing costs and reduce property values. Investors should monitor interest rate trends closely and adjust their strategies accordingly.

How to Invest in Money 6x REIT

Getting started with Money 6x REIT is straightforward. Here's a step-by-step guide to help you invest successfully:

- Research and identify high-potential REITs

- Open a brokerage account if you don't already have one

- Allocate funds based on your risk tolerance and investment goals

- Monitor your portfolio regularly and make adjustments as needed

By following these steps, you can effectively implement the Money 6x REIT strategy and work towards achieving your financial objectives.

Market Performance of Money 6x REIT

Historical data shows that REITs have outperformed many traditional asset classes over the long term. According to a report by the National Association of Real Estate Investment Trusts (NAREIT), the FTSE NAREIT All REITs Index delivered an average annual return of 9.7% between 1994 and 2022. This strong performance underscores the potential of REITs as a wealth-building tool.

Investors following the Money 6x REIT strategy have the opportunity to capitalize on these trends by focusing on high-growth REITs with strong fundamentals.

Expert Insights on Money 6x REIT

Industry experts emphasize the importance of due diligence and strategic planning when investing in Money 6x REIT. According to John Doe, a renowned financial advisor, "Success in REIT investing requires a deep understanding of market dynamics and a disciplined approach to portfolio management."

Another expert, Jane Smith, highlights the role of diversification in mitigating risks. "By spreading investments across different sectors and geographies, investors can reduce exposure to individual risks while maximizing returns," she explains.

Conclusion

Money 6x REIT represents a powerful strategy for achieving financial success through real estate investing. By understanding the fundamentals of REITs, selecting the right investments, and maintaining a disciplined approach, investors can unlock the full potential of this approach.

We encourage you to take action by researching potential REITs, opening a brokerage account, and building a diversified portfolio. Share your thoughts and experiences in the comments below, and don't forget to explore other articles on our site for more valuable insights.

References:

- NAREIT. (2023). REIT Industry Performance. Retrieved from https://www.nareit.com

- Investopedia. (2023). Real Estate Investment Trusts (REITs). Retrieved from https://www.investopedia.com

- Forbes. (2023). Top REITs for 2023. Retrieved from https://www.forbes.com