PPP Warrant List has become a crucial topic of discussion in the financial world, especially for businesses that participated in the Paycheck Protection Program (PPP). Understanding this list is vital for both lenders and borrowers to ensure transparency and accountability in the PPP loan process.

The Paycheck Protection Program, a part of the CARES Act, was introduced to support small businesses during the economic challenges brought on by the pandemic. However, as the program progressed, the need for a PPP warrant list emerged to monitor potential fraud and misuse of funds.

This article dives deep into the PPP warrant list, explaining its purpose, how it works, and its implications for businesses. Whether you're a business owner or a financial professional, this guide will provide you with all the necessary information to navigate this complex topic effectively.

Read also:Unveiling The Age Of Sebastian Stan How Old Is He Really

Table of Contents

- Introduction to PPP Warrant List

- What is the PPP Program?

- What is the PPP Warrant List?

- The Importance of PPP Warrant List

- How Does the PPP Warrant List Work?

- Eligibility Criteria for PPP Loans

- Fraud Prevention in PPP Loans

- Legal Implications of the PPP Warrant List

- Impact on Businesses

- Future Direction of PPP Warrant List

- Conclusion

Introduction to PPP Warrant List

The Paycheck Protection Program (PPP) was established to provide financial relief to small businesses affected by the pandemic. However, with billions of dollars distributed, the need for oversight became paramount. This is where the PPP warrant list comes into play.

This list serves as a tool to identify businesses or individuals who may have misused PPP funds. It is regularly updated by federal authorities to ensure that taxpayer money is used responsibly. Understanding the PPP warrant list is essential for businesses to avoid legal complications.

Key Features of the PPP Warrant List

The PPP warrant list is a comprehensive database that includes businesses suspected of fraudulent activities. It is maintained by the Small Business Administration (SBA) and other federal agencies to monitor PPP loan recipients.

- Identifies businesses suspected of fraud.

- Provides transparency in the PPP loan process.

- Helps lenders make informed decisions.

What is the PPP Program?

The Paycheck Protection Program (PPP) was introduced as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. It aimed to provide financial assistance to small businesses to help them retain their workforce during the pandemic.

Under this program, businesses could apply for forgivable loans to cover payroll costs, rent, utilities, and other operational expenses. The PPP played a crucial role in stabilizing the economy during a challenging period.

PPP Program Objectives

The primary objectives of the PPP program were to:

Read also:Understanding The Conversion Of 130 Lbs In Kg

- Provide financial relief to small businesses.

- Support job retention and economic recovery.

- Ensure funds are used for intended purposes.

What is the PPP Warrant List?

The PPP warrant list is a database maintained by federal authorities to track businesses suspected of misusing PPP funds. It includes companies that have been flagged for potential fraud or non-compliance with PPP guidelines.

This list is regularly updated based on investigations conducted by the SBA and other regulatory bodies. Businesses on this list may face legal consequences, including fines or criminal charges.

How the PPP Warrant List is Compiled

The PPP warrant list is compiled through a rigorous process involving:

- Data analysis of PPP loan applications.

- Investigations by federal agencies.

- Input from whistleblowers and other sources.

The Importance of PPP Warrant List

The PPP warrant list plays a critical role in ensuring the integrity of the PPP program. By identifying businesses suspected of fraud, it helps protect taxpayer funds and promotes accountability in the loan process.

For lenders, the PPP warrant list serves as a valuable tool to assess the risk associated with potential borrowers. It also helps businesses understand the importance of compliance with PPP guidelines.

Benefits of the PPP Warrant List

The key benefits of the PPP warrant list include:

- Enhanced transparency in the PPP loan process.

- Protection of taxpayer funds from misuse.

- Improved decision-making for lenders.

How Does the PPP Warrant List Work?

The PPP warrant list operates through a combination of data analysis, investigations, and collaboration between federal agencies. Businesses are added to the list based on evidence of fraudulent activities or non-compliance with PPP guidelines.

Once a business is added to the list, it may face legal action, including audits, fines, or criminal charges. The list is regularly updated to reflect the latest findings and ensure accuracy.

Steps in the PPP Warrant List Process

The process involves the following steps:

- Identification of suspicious activities.

- Investigation by federal agencies.

- Publication of findings on the warrant list.

Eligibility Criteria for PPP Loans

To qualify for a PPP loan, businesses must meet specific eligibility criteria. These criteria ensure that funds are distributed to businesses that truly need them and are committed to using them responsibly.

Eligible businesses include small businesses, non-profits, and self-employed individuals. They must demonstrate a need for the funds and agree to use them for eligible expenses.

Key Eligibility Requirements

The main eligibility requirements for PPP loans are:

- Businesses with fewer than 500 employees.

- Proof of financial need due to the pandemic.

- Agreement to use funds for eligible expenses.

Fraud Prevention in PPP Loans

Fraud prevention is a top priority in the PPP program. The PPP warrant list is one of the tools used to combat fraud and ensure the responsible use of funds. Federal agencies employ advanced technologies and investigative techniques to detect and prevent fraudulent activities.

Businesses are encouraged to adhere to PPP guidelines and maintain accurate records to avoid suspicion of fraud. Compliance with these guidelines is essential for avoiding legal complications.

Strategies for Preventing PPP Fraud

Some effective strategies for preventing PPP fraud include:

- Implementing robust internal controls.

- Conducting regular audits and reviews.

- Providing training on PPP guidelines.

Legal Implications of the PPP Warrant List

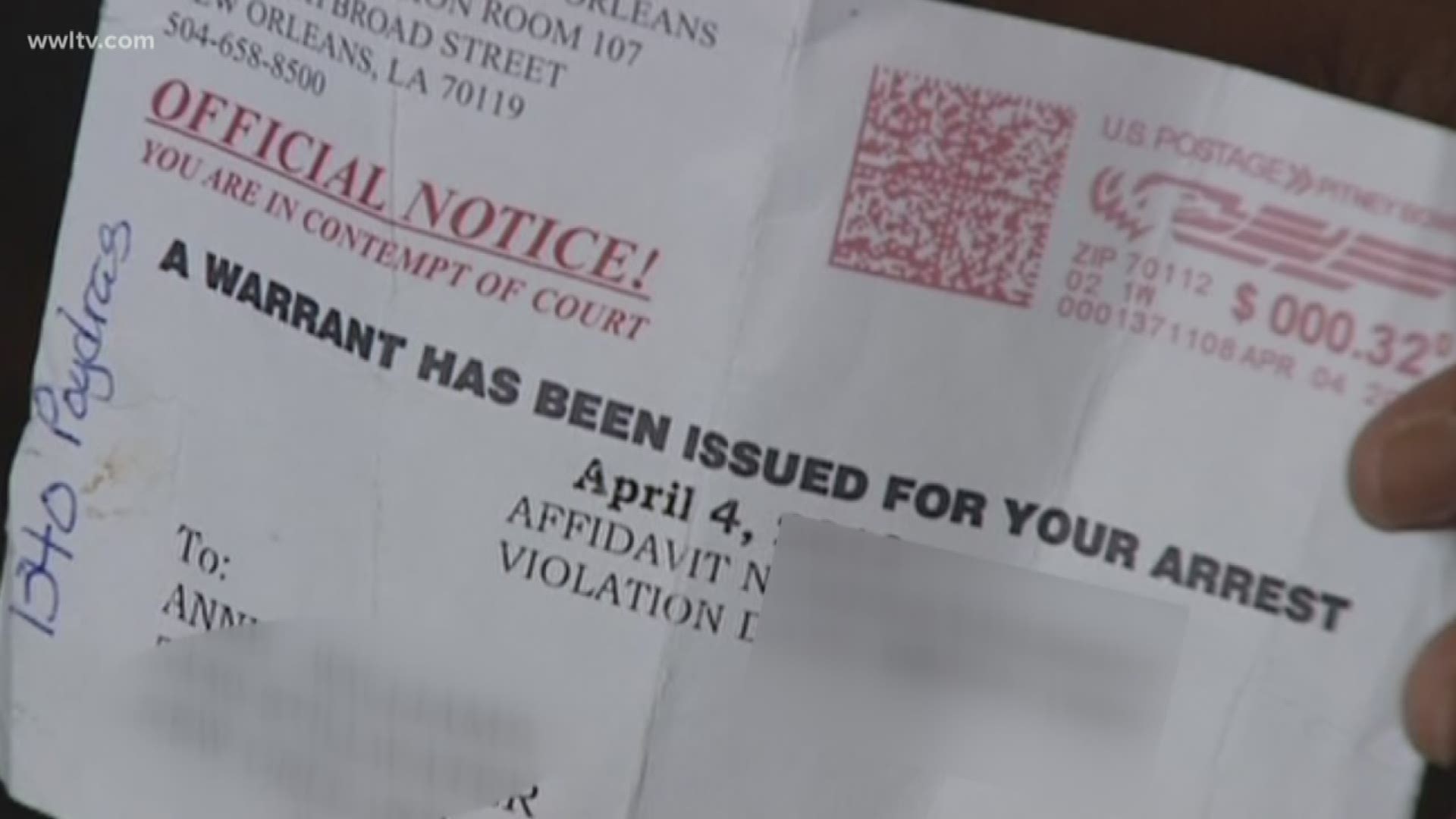

The PPP warrant list has significant legal implications for businesses. Being added to the list can result in serious consequences, including financial penalties and criminal charges. Businesses must take proactive steps to ensure compliance with PPP guidelines and avoid potential legal issues.

Legal experts recommend seeking professional advice to navigate the complexities of the PPP program and address any concerns related to the warrant list.

Legal Consequences of PPP Fraud

Potential legal consequences for businesses on the PPP warrant list include:

- Civil penalties, such as fines.

- Criminal charges, including imprisonment.

- Damage to reputation and credibility.

Impact on Businesses

The PPP warrant list can have a significant impact on businesses. Being added to the list can damage a business's reputation and hinder its ability to secure future financing. It is crucial for businesses to maintain transparency and adhere to PPP guidelines to avoid such outcomes.

Businesses should regularly review their compliance with PPP regulations and address any potential issues proactively. This approach not only protects them from legal trouble but also enhances their credibility in the eyes of lenders and stakeholders.

How Businesses Can Protect Themselves

Businesses can protect themselves from the PPP warrant list by:

- Maintaining accurate and complete records.

- Seeking professional guidance on PPP compliance.

- Addressing any concerns promptly and transparently.

Future Direction of PPP Warrant List

The future direction of the PPP warrant list will likely involve advancements in technology and data analytics to enhance its effectiveness. Federal agencies are continuously improving their methods for detecting and preventing fraud, ensuring the integrity of the PPP program.

As the program evolves, businesses must stay informed about updates and changes to PPP guidelines. Staying compliant with these guidelines will help them avoid potential issues related to the warrant list.

Trends in PPP Warrant List Development

Some trends in the development of the PPP warrant list include:

- Increased use of artificial intelligence for data analysis.

- Enhanced collaboration between federal agencies.

- Greater emphasis on transparency and accountability.

Conclusion

The PPP warrant list is a vital tool for ensuring the integrity and transparency of the Paycheck Protection Program. By identifying businesses suspected of fraud, it helps protect taxpayer funds and promotes accountability in the loan process.

Businesses must understand the importance of compliance with PPP guidelines to avoid potential legal issues. Staying informed about updates and changes to the program is essential for navigating this complex landscape successfully.

We encourage readers to share their thoughts and experiences in the comments section below. For more information on PPP loans and related topics, explore our other articles on the website.